|

An angel investor (business angel in Europe, or

simply angel) is an affluent individual who provides capital

for a business start-up, usually in exchange for ownership equity.

Unlike venture

capitalists, angels typically do not manage the pooled money of

others in a professionally-managed fund. However, angel investors

often organize themselves into angel networks or angel

groups to share research and pool their own investment capital.

Angel capital fills the gap in start-up financing between the

"three F"s (friends, family and fools) and venture capital.

While it is usually difficult to raise more than $100,000 - $200,000

from friends and family, most venture capital funds will not consider

investments under $1 - 2 million. Thus, angel investment is a common

second round of financing for high-growth start-ups, and accounts in

total for more money invested annually than all venture capital funds

combined ($24 billion vs. $22 billion in the US in 2004, according the

University of New Hampshire's Center for Venture Research).

Jameson

Hunter - Author: "It's a risky business"

Angel investments bear extremely high risk, and thus require a very

high return on investment. Some angel investors seek a return of at

least 10-20 times their original investment within 5 years, through a

defined exit strategy, such as plans for an initial public offering or

an acquisition. Angel financing can thus be an expensive source of

funds. However, cheaper sources of capital, such as bank financing,

are usually not available for most early-stage ventures.

Angel investors are often retired business owners or executives,

who may be interested in angel investing for other reasons in addition

to pure monetary return. These include wanting to keep abreast of

current developments in a particular business arena, mentoring another

generation of entrepreneurs, and making use of their experience and

networks on a less-than-fulltime basis. Thus, in addition to funds,

angel investors can often provide valuable management advice and

important contacts.

According to the Center for Venture Research, there were 225,000

active angel investors in the U.S. last year. Beginning in the late

1980s, angels started to coalesce into informal groups with the goal

of sharing deal flow and due diligence work, and pooling their funds

to make larger investments. Angel groups are generally local

organizations made up of 10 to 150 accredited investors interested in

early-stage investing. In 1996 there were about 10 angel groups in the

U.S.; now there are over 200. In January, 2004 the not-for-profit

Angel Capital Association, and later the Angel Capital Educational

Foundation, were formed under the auspices of the Ewing Marion

Kauffman Foundation, bringing together over 100 of the most active

angel groups in the United States. The ACA and ACEF have an annual

summit meeting each year in a different city, bringing together the

leaders of the different groups to exchange best practices.

In 2004, according to the Center for Venture Research, 18.5% of

deals that got through the early screens of angel groups and were

presented to investors attracted funding, up significantly from 10% in

2003, which is about the historical average. But since this figure

discounts the substantial initial screening, the percentage of all

companies seeking angel financing that actually receive funding is

closer to 0.5%-1% (but still higher than the 0.2%-0.25% of applicants

who receive funding from venture capitalists). Approximately 45,000 US

companies received angel funding in 2004, and on average, each raised

about $469,000. The lion's share went to high-tech companies, and the

single biggest category within high tech was software.

At

the moment (2013) electronics and satellite communications are big

earners, typically concerning navigation. Globally, governments are

struggling to reduce pollution from ships, with operators being fined

for dirty exhausts and dumping oily water at sea. ClassNK

in Japan and the Technology

Strategy Board in the UK are encouraging research projects to clean

up the oceans with grants of 50% to spur development. But with such high

development costs and the present economic climate, is 50% enough?

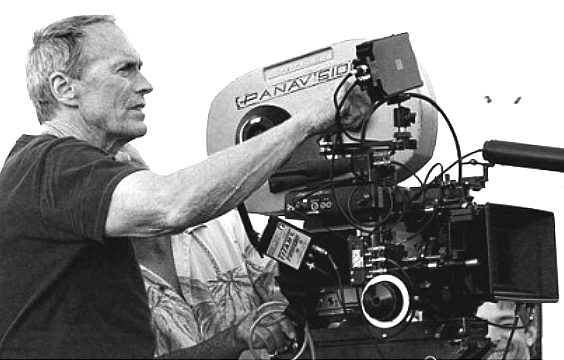

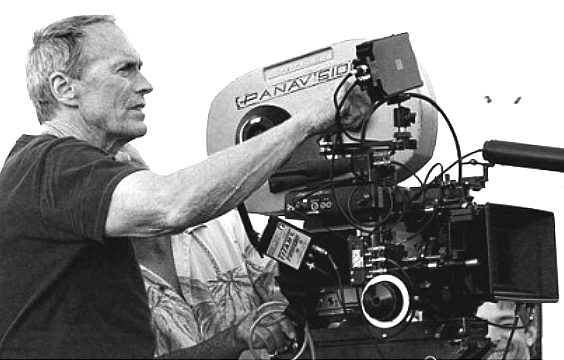

FILM

ANGELS

Traditionally,

Angels are the financiers of the film world. Typically, an Angel may be

an actor or director who is interested in seeing a particular kind of

film being made, or maybe, they want a part in producing or acting in

the movie. In that case there is a vested interest in helping to finance

such a project.

BRITISH

FILM INSTITUTE

The BFI was founded in 1933. They are a charity governed by Royal Charter.

They combine cultural, creative and industrial roles, bringing together the BFI National Archive and BFI Reuben Library, film distribution, exhibition at BFI Southbank and BFI IMAX, publishing and festivals.

They award Lottery funding to film production, distribution, education, audience development and market intelligence and research.

Film Fund

The Film Fund is the production and development heart of the BFI, supporting filmmakers in the UK who are emerging or world class and capable of creating distinctive and entertaining work.

Production awards

In 2013/14 the Film Fund will make approximately 20 major production awards per year. Priority will be given to projects demonstrating a bold vision and creative excellence from new and established filmmakers, across a range of budgets and in any genre, that enrich British film culture and showcase the diversity of the UK and its storytellers.

Development awards

Pursuing creative excellence in the development of new material is fundamental to a film’s commercial and critical success. The Film Fund makes approximately 150 awards a year for the development of feature film projects, and in 2013/14

they will continue to make development a key priority of the Fund, with annual funding increases for development.

BFI BUSINESS PLAN - STRATEGY - 2013 to 2017

BFI strategy aims to support the future success of British film by placing a strong emphasis on new voices and fresh ideas, nurturing and investing in a diverse mix of first-class filmmaking activity across the UK, from emerging to established filmmakers, that will enrich

British film culture, increase the economic value of UK film and define Britain and its storytellers in the 21st century.

Working with their strategic partners, the BFI have created a series of interventions to stimulate and strengthen the quality and value of British film. These interventions – awards for production and development, business development and talent and skills – are designed to help promote a flourishing film culture and a prosperous film industry, to support the further development of world-class skills, to build stronger British film companies and to strengthen British film culture. They are also designed to help the UK film industry strengthen its global position through support for inward investment and exports, co-production, cultural exchange and other international partnerships.

Investment in film production and development

The BFI will put exemplary filmmaking talent at the heart of their strategy, supporting bold new visions from emerging and established filmmakers who have the ambition to connect with their audiences. The most significant responsibility of the BFI Film Fund is its support of UK feature film development and production and – integral to this – supporting the growth of high-calibre filmmakers at all stages of their careers.

The Film Fund makes approximately 150 awards a year for the development of feature film projects, and we will continue to make development a key priority of the Fund with a number of new initiatives including Vision Awards 2, which will support production companies so that they can develop material with creative autonomy, and also a series of targeted programmes to support development in areas needing special attention, such as animation, family films and comedy.

The BFI will also launch a major UK-wide New Talent Network to discover and nurture the best new filmmaking talent across the UK, in partnership with Creative England, the National Screen Agencies, Film London and Creative Skillset.

Investment in skills and business development

The BFI believes that investing in skills is vital, but with increasing demands from a successfully growing sector,

they need to ensure that this skills base is effectively supported. The

BFI will work with Creative Skillset and the Department for Business, Innovation and Skills to develop and execute an advocacy plan to help ensure that investment is adequate.

The BFI will join with public sector partners across the UK to support businesses in creating and harnessing business development opportunities especially in the areas of access to finance, innovation, exploitation of IP and international markets.

Investment in strengthening international reach

The BFI will take a leadership role in implementing an international strategy for film stimulated by the targeted use of Lottery and Grant in Aid funding with partners. To underpin the international strategy,

they have created an International Fund with specific support for inward investment and film exports.

http://industry.bfi.org.uk/filmfund

http://www.bfi.org.uk/about-bfi

THE

WALL STREET JOURNAL WSJ BLOGS - Angel Group Likes Lights, Camera And Action Of Indie Films

As an experienced tech entrepreneur and angel investor, Rizwan Virk was happy to see a solid return on one of his recent investments after just one year.

But the exit didn’t come from a software start-up or social media company finding a corporate acquirer. Instead, Virk’s quick payoff came from an independent film.

Virk is a member of FilmAngels, a Silicon Valley group whose members back film productions – mostly small, independent projects. Founded in 2005, Film Angels is made up mostly of tech executives and investors who apply their business and venture capital experience to the filmmaking world.

FilmAngels meets regularly, seeing about five pitches per month. Members are free to invest in whichever projects they choose. The group pre-screens the films, but does not endorse any particular films. About 12 films have been funded through the group, which invites hundreds of accredited investors to its events and has a smaller number of paid members, said Thomas Trenker, managing director at FilmAngels.

For many members of Film Angels, the about-face from their usual areas of investing is what makes the space appealing.

“A lot of investors I see FilmAngels resonate for are already successful investors and very heavily weighted in other asset classes such as technology or software,” said Saad Khan, a FilmAngels member and partner at CMEA Capital. “This is a way to diversify their whole asset class in new areas.”

Investing in technology is Virk’s specialty, having invested in Offerpal Media Inc., a large player in online gaming monetization, and Tapjoy, a mobile game developer. He also was previously chief executive of CambridgeDocs, which was acquired by EMC Document Sciences in 2007.

One film he invested in, “Turquoise Rose” – a coming-of-age story about a Navajo girl from suburban Phoenix who is forced to spend a summer on a Native American reservation – made its money back in under a year, despite the film not having big Hollywood distribution. The filmmakers and Virk self-distributed the film, focusing on the West and Southwest regions, where there are larger Native American populations and strong interest in the film’s topics.

Virk said he made 20% in profit after one year investing in the film, though he declined to say how much he invested. Many of the angels in the group invest in the “low six figures” per film, Trenker said. While such returns are not comparable to VC blockbuster deals, they have the virtue of a much quicker turnaround than the standard VC investment.

The VC model does play a role in the film financing. There are a range of ways that films are financed and structured, particularly for independent films. But many of these films don’t usually include VC-style concepts like classes of stock, valuation or liquidation preferences, Khan said, which give investors different rights based on when and how they invest.

FilmAngels investors seek to include more standardized concepts so that, for example, investors receive protections or preferences for investing at an earlier stage.

“Deals I’ve been in, you get 115% or 120% back, then profits are spread based on some ratio between producers and investors,” Virk said. “It’s similar to a 1.2x liquidation preference.”

At a recent FilmAngels event in San Francisco, director Dan Frisch screened his film, “The Rainbow Tribe,” which has yet to be released. Frisch’s case – he is seeking funding for a follow-up to “The Rainbow Tribe” – is somewhat rare for FilmAngels because, unlike most of those who pitch the group, he is not a neophyte filmmaker, having directed films such as “The League of Extraordinary Gentlemen” and films in the “Hostel” franchise.

But even though Frisch is an established filmmaker, he said he came to FilmAngels because there are surprisingly few groups in the industry where savvy investors are interested in being intimately involved in film projects. “I don’t want an arms’ length investor,” Frisch said.

Virk said a healthy rapport between filmmaker and investor is essential for the model to work. “I look for people who are entrepreneurial,” he said of the investments he considers. “They understand that this is a business and they need to make money back for investors.”

http://filmangels.org/

http://blogs.wsj.com/venturecapital/2009/10/12/angel-group-likes-lights-camera-and-action-of-indie-films/

MONEY

FINDER

REFERENCES

and LINKS:

|

Blueplanet

Productions 2014 - 2016

|

The

Adventures of John Storm: KULO

LUNA™ - The $Billion Dollar Whale © BPH Ltd MMXIII |

|

|

A.

Pre-production

unit costs

|

55,370.00 |

L.

Travel

/ hotel accommodation

|

335,000.00 |

|

B.

Above

the line costs -prod execs |

25,907,500.00 |

M.

Publicity

/ screenings |

176,400.00 |

|

C.

Crew

- Main unit |

693,803.00 |

N.

Legal,

accounting. ins (Int, film guarantors) |

477,010.00 |

|

D.

Crew

- 2nd & 3rd units |

278,680.00 |

O.

Contingency

@ 10% |

7,254,830.00 |

|

E.

Cast

+ options |

20,290,000.00 |

P.

Producer's

/ Director's dividends (%) |

TBA |

|

F.

Computer

graphics (CGI) |

17,500,000.00 |

Q.

Distribution

- Direct (costs) |

27,959,000.00 |

|

G.

Art

department |

986,300.00 |

R.

Profit

projected on sales (before corp. tax) |

536,370,000.00 |

|

H.

Equipment |

242,850.00 |

S.

Finance

/ Interest

(5 yrs) |

53,876,570.00 |

|

I.

Location

/ transport / catering |

809,502.00 |

T.

Total

target film cost (production & distribution) |

107,753,138.00 |

|

J.

Stock,

lab, video transfers |

312,195.00 |

U.

Studio

property / equipment (invest) |

TBA |

|

K.

Post

production |

190,510.00 |

. |

. |

|

|

|

. |

. |

|

|

|

Sales |

*698,000,000.00 |

|

|

|

Cost

of Sales |

161,629,710.00 |

|

|

|

Net

Profit* |

*Subj.

corp. taxes |

|

. |

|

|

Blueplanet

Universal Productions

KULO

LUNA™ © BH Ltd MMXIII

|

|