|

CREDIT CARDS

|

|||

|

WHAT IS A CREDIT CARD

A credit card system is a type of retail transaction settlement and credit system, named after the small plastic card issued to users of the system. A credit card is different from a debit card in that the credit card issuer lends the consumer money rather than having the money removed from an account. It is also different from a charge card (though this name is sometimes used by the public to describe credit cards) in that charge cards require that the balance be paid in full each month. In contrast, a credit card allows the consumer to 'revolve' their balance, at the cost of having interest charged. Most credit cards are the same shape and size, as specified by the ISO 7810 standard.

HOW GOOD IS YOUR CREDIT CARD COMPANY?

Some credit card firms operate in a manner which is dubious and may very well be unlawful. It's all in the small print. However, any terms or conditions that are unreasonable may be the subject of legal challenge or complaint. Hence, the small print may not be worth the paper it's written on.

Take this real life example below concerning balance transfers. Some cards now recognise that the way they calculate interest and/or take preferential payments is not morally right and are advertising operating in the customers best interest as a feature. Well, good on them, but shame on the others!

BALANCE TRANSFERS

BARCLAYCARD

How is interest calculated?

If full payment is not received, interest is charged based on an Average Daily Balance on the account. This is calculated by adding up the outstanding balance on your account each day and dividing by the number of days in the month. The sooner you make a payment to your account, the lower your Average Daily Balance will be and the less interest you will pay.

If you don't pay your bill in full, Barclaycard has a minimum interest charge of 50p.

Balance transfers

If you transfer a credit card balance to Barclaycard, you can enjoy a competitive balance transfer rate. Balance transfers may be subject to a handling charge of 2%. We will make any handling charges clear to you in the terms and conditions accompanying an offer made to you.

When you make a payment to your account, it will go towards paying off your balance transfer first, which means any further purchases you make will be charged at your standard APR. Your repayments will not start reducing the amount you spend on the card until the transferred balance has been cleared. This seems contrary to the core of transfer arrangement - since it traps you into paying interest on new purchases which you cannot clear - thus obviating any advantage of a balance transfer. SEE EXAMPLE BELOW

Clearly, this is a nonsense. There is a minimum payment in respect of a balance transfer. Provided you settle this sum and make it clear to the lender that you wish to settle another sum separately, they should honour your request and be pleased to do so.

Telephone:

0870 154 0154 Postal Address:

Barclaycard, Customer Relations Department, 1234 Pavilion Drive, Northampton, NN4 7SG

Financial

Ombudsman Service

HOW CREDIT CARDS WORK

A user is issued a credit card after an account has been approved by the credit provider (often a general bank, but sometimes a captive bank created to issue a particular brand of credit card, such as American Express Centurion Bank), with which he or she will be able to make purchases from merchants accepting that credit card up to a preestablished credit limit.

When a purchase is made, the credit card user agrees to pay the card issuer. Originally the user would indicate his/her consent to pay, by signing a receipt with a record of the card details and indicating the amount to be paid, but many merchants now accept verbal authorizations via telephone and electronic authorization using the Internet.

Electronic verification systems allow merchants (using a strip of magnetized material on the card holding information in a similar manner to magnetic tape or a floppy disk) to verify that the card is valid and the credit card customer has sufficient credit to cover the purchase in a few seconds, allowing the verification to happen at time of purchase. Other variations of verification systems are used by eCommerce merchants to determine if the user's account is valid and able to accept the charge.

Each month, the credit card user is sent a statement indicating the purchases undertaken with the card, and the total amount owed. The cardholder must then pay a minimum proportion of the bill by a due date, and may choose to pay the entire amount owed or more. The credit provider charges interest on the amount owed (typically at a much higher rate than most other forms of debt). Some financial institutions can arrange for automatic payments to be deducted from the user's accounts.

Credit card issuers usually waive interest charges if the balance is paid in full each month, but typically will charge full interest on the entire outstanding balance from the date of each purchase if the total balance is not paid.

For example, if a user had a $1,000. outstanding balance for purchases and pays the entire $1,000. there would be no interest charged. If, however, even $1.00 of the total balance remained unpaid, interest would be charged on the full $1,000 from the date of purchase until the payment is received. The precise manner in which interest is charged is usually detailed in a cardholder agreement which may be summarized on the back of the monthly statement. (See The TD Gold Travel Visa Cardholder Agreement Retrieved January 3, 2006)

The credit card may simply serve as a form of revolving credit, or it may become a complicated financial instrument with multiple balance segments each at a different interest rate, possibly with a single umbrella credit limit, or possibly with separate credit limits applicable to the various balance segments. Usually this compartmentalization is the result of special incentive offers from the issuing bank, either to incent balance transfers from cards of other issuers, or to incent more spending on the part of the customer.

In the event that several interest rates apply to various balance segments, payment allocation is generally at the discretion of the issuing bank, and payments will therefore usually be allocated towards the lowest rate balances until paid in full before any money is paid towards higher rate balances. Interest rates can vary considerably from card to card, and the interest rate on a particular card may jump dramatically if the card user is late with a payment on that card or any other credit instrument. As the rates and terms vary, services have been set up allowing users to calculate savings available by switching cards, which can be considerable if there is a large outstanding balance (see external links for some on-line services).

Because profit margins in the credit card industry can be quite high, credit providers often offer incentives such as frequent flier miles, gift certificates, or cash back (typically 1 percent) to try to attract customers to their program.

Low interest credit cards or even 0% interest credit cards are available. The only downside to consumers is that the period of low interest credit cards is limited to a fixed term, usually between 6 and 12 months. However, services are available which alert credit card holders when their low interest period is due to expire. Most such services charge a monthly or annual fee. To compare interest on credit cards you can visit http://www.bestcreditrates.net

The merchant's side

For merchants, a credit card transaction is often more secure than other forms of payment, such as cheques, because the issuing bank commits to pay the merchant the moment the transaction is verified. The bank charges a commission (Interchanging Fee), to the merchant for this service and there may be a certain delay before the agreed payment is received by the merchant. In addition, a merchant may be penalized or have their ability to receive payment using that credit card restricted if there are too many cancellations or reversals of charges.

Secured credit cards

A secured credit card is a type of credit card secured by a deposit account owned by the cardholder. Typically, the cardholder must deposit between 100% and 200% of the total amount of credit desired. Thus if the cardholder puts down $1000, he or she will be given credit in the range of $500–$1000. In some cases, credit card issuers will offer incentives even on their secured card portfolios. In these cases, the deposit required may be significantly less than the required credit limit, and can be as low as 10% of the desired credit limit. This deposit is held in a special savings account.

The cardholder of a secured credit card is still expected to make regular payments, as he or she would with a regular credit card, but should he or she default on a payment, the card issuer has the option of recovering the cost of the purchases paid to the merchants out of the deposit.

Although the deposit is in the hands of the credit card issuer as security in the event of default by the consumer, the deposit will not be credited simply for missing one or two payments. Usually the deposit is only used as an offset when the account is closed, either at the request of the customer or due to severe delinquency (150 to 180 days). This means that an account which is less than 150 days delinquent will continue to accrue interest and fees, and could result in a balance which is much higher than the actual credit limit on the card. In these cases the total debt may far exceed the original deposit and the cardholder not only forfeits their deposit but is left with an additional debt.

Most of these conditions are usually described in a cardholder agreement which the cardholder signs when their account is opened.

Secured credit cards are an option to allow a person with a poor credit history or no credit history to have a credit card which might not otherwise be available. They are often offered as a means of rebuilding one's credit. Secured credit cards are available with both Visa and MasterCard logos on them. Fees and service charges for secured credit cards often exceed those charged for ordinary non-secured credit cards, however, for people in certain situations, (for example, after charging off on other credit cards, or people with a long history of delinquency on various forms of debt), secured cards can often be less expensive in total cost than unsecured credit cards, even including the security deposit.

Features

As well as convenient, accessible credit, the cards offer consumers an easy way to track expenses, which is necessary both for monitoring personal expenditures and the tracking of work-related expenses for taxation and reimbursement purposes. They have now spread worldwide, and are offered in a huge variety of permutations with differing credit limits, repayment arrangements such as automatic payment from a personal bank account (some cards offer interest-free periods, while others do not but compensate with much lower interest rates), and other perks (such as rewards schemes in which points earned by purchasing goods with the card can be redeemed for further goods and services or credit card cashback).

Some countries such as the United States and the United Kingdom limit the amount for which a consumer can be held liable due to fraudulent transactions as a result of a consumer's credit card being lost or stolen.

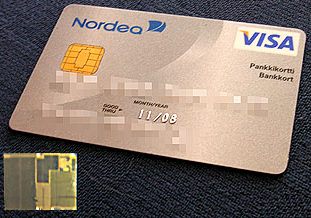

A smart card, combining credit card and debit card properties A 3 by 5 mm security chip is embedded in the card enabling electronic access to the chip

Security

The low security of the credit card system presents countless opportunities for fraud. This opportunity has created a huge black market in stolen credit card numbers, which are generally used quickly before the cards are reported stolen.

The goal of the credit card companies, as they say, is not to eliminate fraud, but to "reduce it to manageable levels", such that the total cost of both fraud and fraud prevention is minimized. This implies that high-cost low-return fraud prevention measures will not be used if their cost exceeds the potential gains from fraud reduction.

Most Internet fraud is done through the use of stolen credit card information which is obtained in many ways, the simplest being copying information from retailers, either online or offline. There have been many cases of hackers obtaining huge quantities of credit card information from company databases. It is not unusual for employees of companies that deal with millions of customers to sell credit card information to criminals.

Despite efforts to improve security for remote purchases using credit cards, systems with security holes are usually the result of poor implementations of card acquisition by merchants. For example, a website that uses SSL to encrypt card numbers from a client may simply email the number from the webserver to someone who manually processes the card details at a card terminal. Naturally, anywhere card details become human-readable before being processed at the acquiring bank is a security risk. However, many banks offer systems such as ClearCommerce, where encrypted card details captured on a merchant's webserver can be sent directly to the payment processor.

The Federal Bureau of Investigation is the agency responsible for prosecuting criminals who engage in credit card fraud in the United States, but they do not have the resources to pursue all criminals. In general, they only prosecute in cases exceeding $5,000 in value. Even though the FBI usually does not investigate, most common credit card networks have not implemented procedures to prevent credit card fraud. Three improvements to card security have been introduced to the more common credit card networks but none has proven to help reduce credit card fraud so far. First, the on-line verification system used by merchants is being enhanced to require a 4 digit Personal Identification Number (PIN) known only to the card holder. Second, the cards themselves are being replaced with similar-looking tamper-resistant smart cards which are intended to make forgery more difficult. The majority of smartcard (IC card) based credit cards comply with the EMV (Europay MasterCard Visa) standard. Third, an additional 3 or 4 digit code is now present on the back of most cards, for use in "card not present" transactions. See CVV2 for more information.

Profits and losses

Credit card issuers (banks) have several types of costs:

Offsetting those costs are the following revenues:

Credit card companies generally guarantee the merchant will be paid on legitimate transactions regardless of whether the consumer pays their credit card bill. However, credit card companies generally will not pay a merchant if the consumer challenges the legitimacy of the transaction and will fine merchants who have a large number of chargebacks.

In recent times, credit card portfolios have been very profitable for banks, largely due to the booming economy of the late nineties. However in the case of credit cards, such high returns go hand in hand with risk, since the business is essentially one of making unsecured (uncollateralized) loans, and thus dependent on borrowers not to default in large numbers.

In some areas, such as Ireland, governments profit from credit cards through the imposition of a stamp duty or credit card tax. This is usually done where a cheque tax previously existed. This tax is taken automatically from the account, just like a purchase, by the bank on behalf of the government annually. This tax - unlike its cheque counterpart - is payable in arrears so no refund is possible.

HISTORY

The credit card was the successor of a variety of merchant credit schemes. It was first used in the 1920s, in the United States, specifically to sell fuel to a growing number of automobile owners. In 1938 several companies started to accept each other's cards.

The concept of using a card for purchases was invented in 1887 by Edward Bellamy and described in his utopian novel Looking Backward. Bellamy uses the explicit term "Credit Card" 11 times in his novel (Chapters 9, 10, 11, 13, 25 and 26) and 3 times (Chapters 4, 8 and 19) in its sequel, Equality.

The concept of paying merchants using a card was invented in 1950 by Ralph Schneider and Frank X. McNamara in order to consolidate multiple cards. The Diners Club produced the first "general purpose" charge card, which is similar but required the entire bill to be paid with each statement; it was followed shortly thereafter by American Express. Western Union had begun issuing charge cards to its frequent customers in 1914.

Bank of America created the BankAmericard in 1958, a product which eventually evolved into the Visa system ("Chargex" also became Visa). MasterCard came to being in 1966 when a group of credit-issuing banks established MasterCharge. The fractured nature of the US banking system meant that credit cards became an effective way for those who were travelling around the country to, in effect, move their credit to places where they could not directly use their banking facilities.

There are now countless variations on the basic concept of revolving credit for individuals (as issued by banks and honored by a network of financial institutions), including organization-branded credit cards, corporate-user credit cards, store cards and so on.

In contrast, although having reached very high adoption levels in the US, Canada and the UK, it is important to note that many cultures were much more cash-oriented in the latter half of the twentieth century (Germany, France, Switzerland, among many others). In these places, the take-up of credit cards was initially much slower. It took until the 1990s to reach anything like the percentage market-penetration levels achieved in the US, Canada or UK. In many countries acceptance still remains poor as the use of a credit card system depends on the banking system being perceived as reliable.

In contrast, because of the legislative framework surrounding banking system overdrafts, some countries, France in particular, were much faster to develop and adopt chip-based credit cards which are now seen as major anti-fraud credit devices.

CONTROVERSY

Credit card companies do not want merchants to charge credit card users more than they charge other customers, even though the merchant pays a fee of 2 to 3 percent (merchants negotiate an exact percentage with their banks) to process credit payments. In some countries this fee may be significantly more. If customers were responsible for this fee, it would often discourage credit card usage. Some critics have observed that this results in what is effectively a hidden tax on all transactions conducted by merchants who accept credit cards since they must build the cost of transaction fees into their overall business expense. The end result is that cash consumers are essentially subsidizing credit card holder purchases. The cost of the convenience enjoyed by card holders and the profits taken from transaction fees by the card industry (which has come to rely increasingly on this revenue stream over the years) is partially offloaded onto the backs of the cash consumer. Critics go on to say that further compounding the issue is the fact that the consumers most likely to pay in cash are the least able to afford the additional expense (card holders are more likely to be affluent, non-card holders less so).

A counter argument is that there are also costs to the merchant in accepting cash, including frequent trips to the bank or use of an armored delivery service, theft, and employee error, such that cash is actually not cheaper for the merchant than credit cards. While businesses are allowed to offer a discount for cash-paying customers, this has become virtually non-existent.

In many places, governments have passed laws (at the urging of the credit card industry) to make this illegal. Despite this, some retailing sectors flout this regulation, especially in areas of very competitive, commodity products such as personal computers, where the fine print of an advertisement states "prices already cash discounted -- surcharge for credit card". Other retailers offer incentives or bonus coupons for using cash, such as Canadian Tire Money. Australia is currently acting to reduce this by allowing merchants to apply surcharges for credit card users. In the United Kingdom, merchants won the right through The Credit Cards (Price Discrimination) Order 1990 to charge customers different prices according to the payment method, but few merchants do so (the most notable exceptions being budget airlines and travel agents). The United Kingdom is the world's most credit-card-intensive country, with 67 million credit cards for a population of 59 million people.

However, there also exists an economic argument that credit card use increases the "velocity" of money in an economy, the result, higher consumer spending rates and higher GDP. Although there is many a sad story of credit card abuse, the trend is increasing use, with some predicting a cashless society in the not so distant future.

There is some controversy about credit card usage in recent years. Credit card debt has soared, particularly among young people. Since the late 1990s, lawmakers, consumer advocacy groups, college officials and other higher education affiliates, have become increasingly concerned about the rising use of credit cards among college students. The major credit card companies have been accused of targeting a younger audience, in particular college students, many of whom are already in debt with college tuition fees and college loans, and who typically are less experienced at managing their own finances. A recent study by United College Marketing Services has shown that student credit lines have increased to over $6,000. Credit card usage has tripled since 2001 amongst teenagers as well. Since eighteen year-olds in many countries and most U.S. states are eligible for a card without parental consent or employment, the likelihood of increased balances, unwise use of credit and damaged credit scores increases.

According to Larry Chiang of United College Marketing Services, an example of a credit card class action was where issuers were "rolling back" posting times to extract more late fees. The due dates were "rolled back" from 1pm to 10am because mail was delivered in the afternoon so due dates were actually rolled back to charge more late fees. The following banks are listed (with the amounts penalized) in this one particular class action.

Another controversial area is the universal default feature of many North American credit card contracts. When a cardholder is late paying a particular credit card issuer, that card's interest rate can be raised, often considerably. Given this circumstance with one credit card, universal default allows other card issuers to raise the cardholder's interest rates on other accounts, even if those other accounts are not in default.

In the USA, Congress has been slow to introduce credit card reform legislation. A push toward expanding the disclosure box and incorporating balance payoff disclosures on credit card statements would go a long way in clarifying credit card debt's ramifications.

MINIMUM PAYMENTS

In the UK, there has recently been increasing concern about the minimum payments required on outstanding credit card balances. Until the mid-1990s the required minimum monthly payment was generally 5% of the outstanding balance, but competition in the last 15 years to attract customers has led to this figure being eroded on the premise that the minimum monthly payment to service a debt will be lower. Typically, credit card companies now only require a monthly minimum payment of between 2% and 3% of the outstanding balance, or a fixed cash fee, whichever is the greater. For example, on a debt of $1,000, the card holder can expect to only have to pay back between $20 and $30 per month.

Unfortunately, some people are not aware of how long it can take to repay a debt when only paying the minimum each month. An example of this: by paying 2.5% of the debt each month, while accruing interest at 14% (in line with modern credit card interest rates), it can take over 14 years to pay back a debt of $1,000.

It has recently been suggested that credit card companies include a warning on their statements discouraging customers from paying only the minimum, however few companies have so far acted upon this. Companies which do include a warning tend not to inform customers how long full repayment will take, i.e. they discourage users from making just minimum payments but do not explain why. Less financially savvy customers may ignore these empty warnings as a result.

Starting in 2006, most US credit card companies regulated by the Office of the Comptroller of the Currency have been required to increase customers' minimum payments to cover at least the interest and late fees from the prior statement plus 1% of the outstanding balance. TRAILING INTEREST

Trailing interest, sometimes called final or residual interest, is a method of calculation whereby interest is charged right up until the day of a full payment. Cardholders of banks that use this method receive a bill with the balance owing and interest accrued and pay it off in full. On the next statement they are billed a "final" amount of interest even if no purchases or cash advances have been debited since. The reason for this is that interest continues to accrue from the time of the close of the previous statement until the day the payment for that statement is actually received.

In comparison to the normal method of interest calculation, this method is judged by many to be a hidden and thus unfair cost. Uninformed cardholders often inquire as to what amount they need to pay by their due date in order to have paid off their credit card in full and to stop interest from accumulating. They then proceed to pay off this amount under the belief that they are finished paying interest charges, only to find trailing interest on their next statement which was posted to their account on the day of the statement billing (so even if they check their balance a day before that next billing date, is would still show a zero balance).

Credit card numbering

The numbers found on credit cards have a certain amount of internal structure, and share a common numbering scheme.

The card number's prefix, called the Bank Identification Number, is the sequence of digits at the beginning of the number that determine the bank to which a credit card number belongs. This is the first six digits for Mastercard and Visa cards. The last ten digits are the individual account number.

In addition to the main credit card number, credit cards also carry issue and expiration dates (given to the nearest month), as well as extra codes such as issue numbers and security codes. Not all credit cards have the same sets of extra codes.

Credit cards in ATMs

Many credit cards can also be used in an ATM to withdraw money against the credit limit extended to the card but many card issuers charge interest on cash advances before they do so on purchases. The interest on cash advances is commonly charged from the date the withdrawal is made, rather than the monthly billing date. Many card issuers levy a commission for cash withdrawals, even if the ATM belongs to the same bank as the card issuer. Merchants do not offer cashback on credit card transactions because they would pay a percentage commission of the additional cash amount to their bank or merchant services provider, thereby making it uneconomical.

Many credit card companies will also, when applying payments to a card, do so at the end of a billing cycle, and apply those payments to everything before cash advances. For this reason, many consumers have large cash balances, which have no grace period and incur interest at a rate that is (usually) higher than the purchase rate, and will carry those balance for years, even if they pay off their statement balance each month.

Credit card networks

Visa's "Happy Shoppers" credit card design

Collectible credit cards

A growing field of numismatics (study of money), or more specifically Exonumia (study of money-like objects), credit card collectors seek to collect various embodiments of credit from the now familiar plastic cards to older paper merchant cards, and even metal tokens that were accepted as merchant credit cards. Early credit cards were made of celluloid, then metal and fiber, then paper and are now mostly plastic. Credit Card scams in popular culture

Credit Cards as funding for entrepreneurs

Credit cards are a creative and risky way for entrepreneurs to acquire capital for their start ups when more conventional financing are unavailable. It is rumoured that Larry Page and Sergey Brin's start up of Google was financed by credit cards to buy the necessary computers and office equipment.

References: Start company with credit card debt Creative business financing options

LINKS:

Magnetic Stripe Technology and Beyond Secret History of the Credit Card (PBS/Frontline/New York Times documentary on Credit Cards) Article from Evolt Validating a Credit Card Number with JavaScript Ericdigests.org Card Usage and Debt among College and University Students Choosing and Using Credit Cards Consumer credit card advice from the Federal Trade Commission Avoiding Credit and Charge Card Fraud From the Federal Trade Commission Choosing a Credit Card Consumer credit card information from the Federal Reserve Board Guard My Credit File Information on consumer credit rights and the financial services industry. Steer Clear in College NPR Story on college credit card debt

Find out more about Personal loans

Find out more about Secured loans

MONEY FINDER

SolarNavigator is to be equipped with the SNAV intelligent autonomous navigation system. This system is thought to be the only system under development that is COLREGs compliant.

|

|||

|

This website is copyright © 1991- 2013 Electrick Publications. All rights reserved. The bird logo and names Solar Navigator and Blueplanet Ecostar are trademarks ™. The Blueplanet vehicle configuration is registered ®. All other trademarks hereby acknowledged and please note that this project should not be confused with the Australian: 'World Solar Challenge'™which is a superb road vehicle endurance race from Darwin to Adelaide. Max Energy Limited is an educational charity working hard to promote world peace.

|

|||

|

AUTOMOTIVE | BLUEPLANET BE3 | ELECTRIC CARS | ELECTRIC CYCLES | SOLAR CARS | SOLARNAVIGATOR |