|

CREDIT CARDS DEBT

|

|||

|

BC News Ask the Expert column gives readers a chance to get their financial questions answered by experts.

This week, Meg Van Rooyen of National Debtline, a free telephone helpline for people with debt problems, helps reader Charlotte Banks.

Ms Banks is struggling to pay back almost £10,000 she owes on credit cards. Debt collectors are now involved in recovering part of the debt, and she is worried about court action.

She has opened another bank account to ensure she has enough money to live off, but she is still struggling to pay back the money she owes.

Credit cards make it easy to get into debt, if you are not very careful

It is important that you start by looking at your debt situation as a whole. There is no point making arrangements to pay one of your creditors without dealing with all the other debts you have too. We would suggest you start by working out a personal budget.

This should list your monthly income from all sources and the ordinary essential monthly outgoings you need to pay to keep the roof over your head.

These include mortgage or rent, fuel, council tax, water, telephone, TV licence, insurance, housekeeping, clothes, travel and son on.

Do not include the payments you are supposed to make on any unsecured credit such as personal loans, overdrafts and credit cards at this stage.

The aim of the personal budget is to see what you have left over after all your essential outgoings have been met. This figure represents the available income that you can realistically afford to use to pay your unsecured creditors.

Making an offer

You can then work out how much to offer to pay each of your creditors on a monthly basis so they each get a share of your available income. The fairest way of doing this is to make offers on a pro rata basis.

You can either make offers to your creditors yourself by writing to them with a copy of your personal budget.

Alternatively you may be able to get a free debt management plan which enables you to make one payment a month which is divided up amongst your creditors for you.

Make sure you pay all your essential outgoings first, and avoid any debt management company that charges you fees to set up a debt management plan.

You cannot force a creditor to accept an offer of payment. But if they can see that you have worked out a reasonable budget plan, and each creditor is getting a fair share of the money available, they are likely to accept.

Ask them to freeze any interest to stop the debt growing even bigger.

Court action

If the creditor takes you to county court, you can offer to pay the debt off - in instalments you can afford - by filling in the forms the court will send you.

All creditors and debt collection agencies have to follow the Office of Fair Trading (OFT) debt collection guidance.

This includes "putting pressure on debtors or third parties is considered to be oppressive."

You can complain to the debt collection agency and your local trading standards department and to the OFT. The guidance is on the OFT's website.

You have done the right thing in moving your wages into a new bank account.

This means you have control over your finances.

It is a good idea to choose an "instant access" type account with no overdraft or cheque facility. A list of these can be found on the Financial Services Authority website. The overdraft can be included with your other credit debts when offers of payment are made.

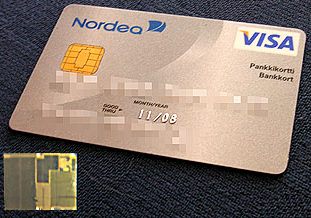

Credit card debt is an example of unsecured consumer debt, accessed through ISO 7810 plastic credit cards.

Credit card debt statistics

Credit card debt is said to be increasing in the industrialized countries. The average U.S. college graduate begins his or her post-college days with more than $2,000 in credit card debt.

Bankruptcy concerns

Political aspects

Reality check

The first step on the road out of debt is to admit - to yourself - just how much trouble you're actually in.

So, before you do anything else, work out your expenditure, and exactly how much you owe.

Once you've done this, you should have a much clearer idea of where corners can be cut.

According to Fool.co.uk, seven out of ten credit applications are likely to be rejected by the time we reach 2012.

For the millions of Britons who are currently getting by on plastic, this is obviously a pretty scary thought. What would our lives be like if we couldn't use credit cards, or go into our overdrafts, or take out loans?

However, every cloud really does have a silver lining. This could be the push we all need to hoist ourselves out of debt - and there's still time to get our finances in order.

Obviously, one way to protect yourself from future turbulence in the credit markets is to try to get into a position where you don't need so much credit. Have a look at the tips below to get away from being credit-dependent:

1. Reduce your outgoings

To minimise your need for credit in the future, you need to tackle the debts you have right now.

So, have a look at your outgoings. If you can, cut the interest payments on your debts. For example, switch your credit card debt to one offering 0% on balance transfers. This means you will stop paying interest on your existing debt, and should allow you to pay it off quicker (as long as you stop spending!).

Set yourself a goal - for example, to reduce your monthly outgoings by £100. Shaving money off household bills, cutting your travel costs and remortgaging your home could all be ways to achieve this.

2. The snowball effect

Once you've whittled down your outgoings to a minimum, snowball your remaining debts. This will help clear them as quickly, and cheaply, as possible.

To do this, work out which of your debts is charging the most interest. That's the one that's growing the fastest - so attack it first.

But before you start, remember that you need to make the minimum payments on all of your borrowings. If you have any spare cash after this, aim it at the most expensive debt. If you don't have any spare cash, make switching this expensive debt to a loan or a credit card that charges less interest a top priority.

When you've paid this 'nasty' off, switch your attention to the next most expensive debt. The cash 'snowballs' you throw at your debt will get larger and larger, and eventually you'll be clear of all your debt.

3. Try to up your income

Another good way to get out of the red is to up your income. Even an extra £100 a month could make a big dent in your debts - and paying them off more quickly could save you hundreds, or even thousands, in interest charges.

4. Saving for a rainy day

After all that dealing with debt, you might think you deserve a reward. By all means enjoy yourself, but don't go spending mad! Instead, start saving your spare cash to set up an emergency fund.

That way, you'll be in an excellent position to weather the predicted financial storms ahead. Remember, you're not alone. See the links below on this page for free impartial advice on how to deal with this growing problem.

A smart card, combining credit card and debit card properties A 3 by 5 mm security chip is embedded in the card enabling electronic access to the chip

FREE DEBT ADVICE

National Debtline (0808 808 4000): Free confidential helpline to those in debt Consumer Credit Counselling Service (0800 1381111): The service offers free advice and information to those affected by debt Citizens Advice: You can find out details of your local CAB by using the website's online directory (see link on right) or by looking up its local offices in your telephone directory

Visa's "Happy Shoppers" credit card design

LINKS and REFERENCE

Citizens Advice Bureau The Citizens Advice Bureau service offers free, confidential, impartial and independent advice. You can find out details of your local CAB by using the website's online directory (see link on right) or by looking up its local offices in your telephone directory.

Consumer Credit Counselling Service The service offers free advice and information to those affected by debt. Consumer

Credit Counselling Service Tel: 0800 138 1111

National Debtline A helpline that offers confidential and independent advice to those in debt. National

Debtline Tel:

0808 808 4000

Advice UK The new name for the Federation of Information and Advice Centres. It is a large network of advice-providing organisations. Telephone: 020 7407 4070 or visit its website. For agencies in Northern Ireland, contact the Association of Independent Advice Centres on 028 9064 5919.

Credit reference agencies The following agencies hold information about people's credit histories. When you apply for a loan or credit card, this information is taken into account before any deal can be approved. You can always check your credit history to make sure the information is correct, by contacting these agencies. Experian

Ltd

Equifax

Credit Information Ireland:

Information Commissioner The commissioner is responsible for enforcing the law regarding data protection and freedom of information Information

Commissioner Tel:

01625 545 745

The Insolvency Service The service provides information for individuals and businesses affected by insolvency. The

Insolvency Service Tel: 020 7291 6895

Council of Mortgage Lenders The CML represents the interests of mortgage lenders in the UK Council

of Mortgage Lenders Tel: 020 7437 0075

Financial Ombudsman Service the Financial Ombudsman Service provides consumers with a free, independent service for resolving disputes with financial firms Financial

Ombudsman Service Tel:

0845 080 1800

Financial Services Authority The FSA aims to maintain efficient, orderly and clean financial markets and help retail consumers achieve a fair deal The

Financial Services Authority Tel: 020 7066 1000

Financial Services Compensation Scheme The FSCS may pay compensation if an authorised firm is unable to pay claims against it. Financial

Services Compensation Scheme Tel: 020 7892 7300 Fax: 020 7892 7301

General Insurance Standards Council The council is the watchdog established to set, monitor and enforce standards in all areas of general insurance, including the fair treatment of customers. General

Insurance Standards Council Tel:

020 7648 7800

The Institute of Chartered Accountants The Institute of Chartered Accountants is the largest professional accountancy body in Europe, with over 125,000 members. Institute

of Chartered Accountants in England & Wales Tel: 0207 920 8100

The Institute of Chartered Accountants of Scotland CA

House Tel:

0131 347 0100

Institute of Financial Planning The Institute is the professional body that represents those involved financial planning. Institute

of Financial Planning Tel.

- 0117 945 2470

Office of Fair Trading The OFT protects consumer rights and ensures that business compete fairly Office

of Fair Trading Tel: 08457 22 44 99

Consumers' Association The Association campaigns on key issues related to consumption of goods and services Consumers'

Association Tel:

020 7770 7000

The Consumer Credit Association The Consumer Credit Association represents businesses involved in the UK credit industry Consumer

Credit Association Tel: 01244 312044

MONEY FINDER

SolarNavigator is to be equipped with the SNAV intelligent autonomous navigation system. This system is thought to be the only system under development that is COLREGs compliant.

|

|||

|

This website is copyright © 1991- 2013 Electrick Publications. All rights reserved. The bird logo and names Solar Navigator and Blueplanet Ecostar are trademarks ™. The Blueplanet vehicle configuration is registered ®. All other trademarks hereby acknowledged and please note that this project should not be confused with the Australian: 'World Solar Challenge'™which is a superb road vehicle endurance race from Darwin to Adelaide. Max Energy Limited is an educational charity working hard to promote world peace.

|

|||

|

AUTOMOTIVE | BLUEPLANET BE3 | ELECTRIC CARS | ELECTRIC CYCLES | SOLAR CARS | SOLARNAVIGATOR |