|

IMF - INTERNATIONAL MONETARY FUND

|

||||||||||||||||||||||||||||||||||

|

HOME | BIOLOGY | FILMS | GEOGRAPHY | HISTORY | INDEX | INVESTORS | MUSIC | SOLAR BOATS | SPORT |

||||||||||||||||||||||||||||||||||

|

The International Monetary Fund (IMF) is an international organization that oversees the global financial system by monitoring exchange rates and balance of payments, as well as offering technical and financial assistance when asked. Its headquarters are in Washington, D.C.

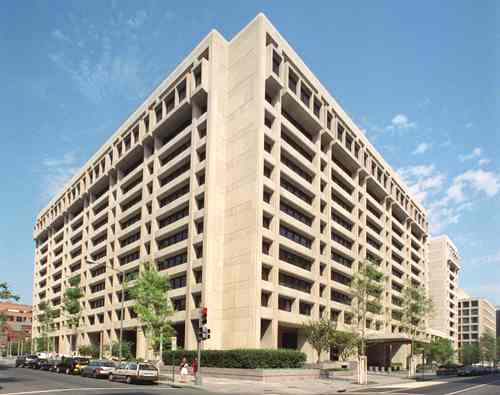

Headquarters building of the International Monetary Fund Washington D.C

Organization and purpose

The IMF describes itself as "an organization of 184 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty". With the exception of North Korea, Cuba, Liechtenstein, Andorra, Monaco, Tuvalu and Nauru, all UN member states either participate directly in the IMF or are represented by other member states.

In the 1930s, as economic activity in the major industrial countries dwindled, countries started adopting mercantilist practices, attempting to defend their economies by increasing restrictions on imports. To conserve dwindling reserves of gold and foreign exchange, some countries curtailed foreign imports, some devalued their currencies, and some introduced complicated restrictions on foreign exchange accounts held by their citizens. These measures were arguably detrimental to the countries themselves as the Ricardian comparative advantage states that everyone gains from trade without restrictions. It is noteworthy to mention that, although the "size of the pie" is enhanced according to this theory of free trade, when distributional concerns are taken into account, there are always industries that lose out even as others benefit. World trade declined sharply, as did employment and living standards in many countries.

As World War II came to a close, the leading allied countries considered various plans to restore order to international monetary relations, and at the Bretton Woods conference the IMF emerged. The founding members drafted a charter (or Articles of Agreement) of an international institution to oversee the international monetary system and to promote both the elimination of exchange restrictions relating to trade in goods and services, and the stability of exchange rates.

The IMF came into existence in December 1945, when the first 29 countries signed its Articles of Agreement. The statutory purposes of the IMF today are the same as when they were formulated in 1944 (see Box 2). From the end of World War II until the late-1970s, the capitalist world experienced unprecedented growth in real incomes. (Since then, China's integration into the capitalist system has added substantially to the growth of the system.) Within the capitalist system, the benefits of growth have not flowed equally to all (either within or among nations) but most capitalist countries have seen recent increases in prosperity that contrast starkly with the conditions within capitalist countries during the interwar period. The lack of a recurring global depression is likely due to improvements in the conduct of international economic policies that have encouraged the growth of international trade and helped smooth the economic cycle of boom and bust.

In the decades since World War II, apart from rising prosperity, the world economy and monetary system have undergone other major changes that have increased the importance and relevance of the purposes served by the IMF, but that has also required the IMF to adapt and reform. Rapid advances in technology and communications have contributed to the increasing international integration of markets and to closer linkages among national economies. As a result, financial crises, when they erupt, now tend to spread more rapidly among countries.

The IMF's influence in the global economy steadily increased as it accumulated more members. The number of IMF member countries has more than quadrupled from the 44 states involved in its establishment, reflecting in particular the attainment of political independence by many developing countries and more recently the collapse of the Soviet bloc. The expansion of the IMF's membership, together with the changes in the world economy, have required the IMF to adapt in a variety of ways to continue serving its purposes effectively.

History

Agreement for the creation of the International Monetary Fund came at the United Nations Monetary and Financial Conference in Bretton Woods, New Hampshire, United States, on July 22, 1944. The principal architects of the IMF at the conference were British economist John Maynard Keynes and the chief international economist at the US Treasury Department, Harry Dexter White. The Articles of Agreement came into force on December 27, 1945, the organization came into existence on May 1, 1946, as part of a post-WWII reconstruction plan, and it began financial operations on March 1, 1947.

It is sometimes referred to as a Bretton Woods institution, along with the International Bank for Reconstruction and Development (now part of the larger World Bank Group).

The IMF is the referee and, when the need arises, rescuer of the world’s financial system. It was set up to supervise the newly established fixed exchange rate system. After this fell apart in 1971–73, the IMF became more involved with its member countries’ economic policies, doling out advice on fiscal policy and monetary policy as well as microeconomic changes such as privatisation, of which it became a forceful advocate. In the 1980s, it played a leading part in sorting out the problems of developing countries’ mounting debt. More recently, it has several times co-ordinated and helped to finance assistance to countries with a currency crisis.

The Fund has been criticised for the conditionality of its support, which is usually given only if the recipient country promises to implement IMF-approved economic reforms. Unfortunately, the IMF has often approved “one size fits all” policies that, not much later, turned out to be inappropriate. It has also been accused of creating moral hazard, in effect encouraging governments (and firms, banks and other investors) to behave recklessly by giving them reason to expect that if things go badly the IMF will organise a bail-out. Indeed, some financiers have described an investment in a financially shaky country as a “moral-hazard play” because they were so confident that the IMF would ensure the safety of their money, one way or another. Following the economic crisis in Asia during the late 1990s, and again after the crisis in Argentina early in this decade, some policymakers argued (to no avail) for the IMF to be abolished, as the absence of its safety net would encourage more prudent behaviour all round. More sympathetic folk argued that the IMF should evolve into a global lender of last resort.

Membership qualifications

Any country may apply for membership of the IMF. The application will be considered, first, by the IMF's Executive Board. After its consideration, the Executive Board will submit a report to the Board of Governors of the IMF with recommendations in the form of a "Membership Resolution." These recommendations cover the amount of quota in the IMF, the form of payment of the subscription, and other customary terms and conditions of membership. After the Board of Governors has adopted the "Membership Resolution," the applicant state needs to take the legal steps required under its own law to enable it to sign the IMF's Articles of Agreement and to fulfill the obligations of IMF membership.

A member's quota in the IMF determines the amount of its subscription, its voting weight, its access to IMF financing, and its allocation of SDRs.

As of 2006, participating nations were discussing changes to the voting formula, to increase equity. [1] Assistance and reforms

The primary mission of the IMF is to provide financial assistance to countries that experience serious financial difficulties. Member states with balance of payments problems may request loans and/or organizational management of their national economies. In return, the countries are usually required to launch certain reforms, an example of which is the "Washington Consensus". These reforms are generally required because countries with fixed exchange rate policies can engage in fiscal, monetary, and political practices which may lead to the crisis itself. For example, nations with severe budget deficits, rampant inflation, strict price controls, or significantly over-valued or under-valued currencies run the risk of facing balance of payment crises in their future. Thus, the structural adjustment programs are at least ostensibly intended to ensure that the IMF is actually helping to prevent financial crises rather than merely funding financial recklessness.

However, this approach is not without its critics, as described below. Many proponents of the IMF contend that some criticisms are the result of the fact that many people are not familiar with the operations and objectives of the IMF, and blame a lack of transparency within the IMF for this, as well as the dense nature of international finance in general. Suggestions for improving these understandings have included greater community outreach efforts, tighter accounting standards, possible regulatory oversight, and changes in the organizational structure of the IMF to include fewer economists, whom many fear are attempting to use developing countries as nothing more than lab rats. Some fear, however, that some of these reforms to the IMF itself introduce political considerations rather than economic considerations, many of which may have resulted in the financial crises in the first place. Criticism

The role of the two Bretton Woods institutions has been controversial to many since the late Cold War period. Critics claim that IMF policy makers deliberately supported capitalistic military dictatorships friendly to American and European corporations. Critics also claim that the IMF is generally apathetic or hostile to their views of democracy, human rights, and labor rights. These criticisms generated a controversy that helped spark the anti-globalization movement. Others claim the IMF has little power to democratize sovereign states, nor is that its stated objective: to advise and promote financial stability. Arguments in favor of the IMF say that economic stability is a precursor to democracy.

Two criticisms from economists have been that financial aid is always bound to so-called "Conditionalities", including Structural Adjustment Programs. Conditionalities, it is claimed, retard social stability and hence inhibit the stated goals of the IMF.

Typically the IMF and its supporters advocate a Keynesian approach. As such, adherents of supply-side economics generally find themselves in open disagreement with the IMF. The IMF frequently advocates currency devaluation, criticized by proponents of supply-side economics as inflationary. Secondly they link higher taxes under "austerity programmes" with economic contraction.

Currency devaluation is recommended by the IMF to the governments of poor nations with struggling economies. Supply-side economists claim these Keynesian IMF policies are destructive to economic prosperity, although many other economists disagree.

Complaints are also directed toward International Monetary Fund gold reserve being undervalued. At its inception in 1945, the IMF pegged gold at 35 dollars per Troy ounce of gold. In 1973 the Nixon administration lifted the fixed asset value of gold in favour of a world market price. Hence the fixed exchange rates of currencies tied to gold were switched to a floating rate, also based on market price and exchange. This largely came about because Petrodollars outside the United States were more than could be backed by the gold at Fort Knox under the fixed exchange rate system. The fixed rate system only served to limit the amount of assistance the organization could use to help debt-ridden countries.

That said, the IMF sometimes advocates "austerity programmes," increasing taxes even when the economy is weak, in order to generate government revenue and balance budget deficits, which is the opposite of Keynesian policy. These policies were criticised by Joseph E. Stiglitz, former chief economist at the World Bank, in his book Globalization and Its Discontents. He argued that by converting to a more Monetarist approach, the fund no longer had a valid purpose, as it was designed to provide funds for countries to carry out Keynesian reflations.

Most altermondialists, like ATTAC, believe that IMF interventions aggravate the poverty and debt of Third World and developing countries. According to the analysis by Yves Engler, the IMF is considered to be responsible for worsening or actually creating famine in Malawi (2002), Ethiopia (2003) and Niger (2005). [2]

Opposition to the IMF is often fragmented. For instance, advocates of supply-side economics would generally regard the policies advocated by ATTAC to be little different in form to the ideas peddled by the IMF. In other words, they would see ATTAC tax-and-spend policies and the IMF's austerity policies as being fundamentally similar.

Argentina, which had been considered by the IMF to be a model country in its compliance to policy proposals by the Bretton Woods institutions, experienced a catastrophic economic crisis in 2001, generally believed to have been caused by IMF-induced budget restrictions — which undercut the government's ability to sustain national infrastructure even in crucial areas such as health, education, and security — and privatization of strategically vital national resources. The crisis added to widespread hatred of this institution in Argentina and other South American countries, with many blaming the IMF for the region's economic problems [3]. The current — as of early 2006 — trend towards moderate left-wing governments in the region and a growing concern with the development of a regional economic policy largely independent of big business pressures has been ascribed to this crisis.

Another example of where IMF Structural Adjustment Programmes aggravated the problem was in Kenya. Before IMF got involved in the country, the Kenya central bank oversaw all currency movement in and out of the country. IMF mandated that Kenya central bank had to allow easier currency movement. However, the adjustment resulted in very little foreign investment, but allowed Kamlesh Manusuklal Damji Pattni, with the help of corrupt government officials, to syphon out billions of Kenya shillings in what came to be known as the Goldenberg scandal, leaving the country in a state worse than that which it was in before the IMF reforms were implemented.

That the IMF intervenes only in countries that experience years of dire economic conditions has certainly hurt its reputation. The financial collapses it intervenes in are products of uneven capitalist development sometimes exacerbated by government mismanagement, but mismanagement is often cited by rich nations as the source of the financial crises. These collapses tend to lead to years of economic difficulty that can be addressed in various ways, but IMF Stuctural Adjustment Policies consistently serve to open up or "liberalize" economies to foreign capital rather than provide for economic recovery through statist policies such as government financed projects to achieve full employment. Thus, IMF policies further the notion that economic development in underdeveloped countries is dependent on attracting foreign investment rather than through a state-managed approach centered on full employment and progressive taxation. It is also true that politicians have used the IMF as an easy target for blame when they themselves have erred, using nationalism to gain easy political points.

Overall the IMF success record is limited. While it was created to help stabilize the global economy, since 1980 over 100 countries have experienced a banking collapse that reduced GDP by four percent or more, far more than at any previous time in history. The considerable delay in IMF response to a crisis, and the fact that it tends to only respond to rather than prevent them, has led many economists to argue for reform.

Whatever the feelings people in the Western world have for the IMF, research by the Pew Research Center shows that more than 60 percent of Asians and 70 percent of Africans feel that the IMF and the World Bank have a positive effect on their country [4]. Such research has made proponents of IMF claim the IMF-critique misleading, as it would be difficult to speak of suffering if the sufferers don't feel hurt.

The documentary Life and Debt deals with the IMF's policies' influence on Jamaica and its economy, from a critical point of view. Past managing directors

An unwritten rule establishes that the IMF's managing director must be European and that the president of the World Bank must be from the United States. Executive Directors, who confirm the managing director are voted in by Finance Ministers from countries they represent.

The IMF is for the most part controlled by the major Western Powers, with voting rights on the Executive board based on a quota derived from a monetary stake in the institution. Rarely does the board vote and pass issues contradicting the will of the US or Europeans. There have been some exceptions in the past. Dr. Mohamed Finaish from Libya, the Executive Director representing the majority of the Arab World and Pakistan, was a tireless defender of the developing nations' rights at the IMF. He stood steadfast in his beliefs and principles for fourteen years until his defeat in the 1992 elections to an Egyptian IMF Staff Member.

LINKS:

NGOs

MONEY FINDER

A taste for adventure capitalists

Solar Cola - a healthier alternative

|

||||||||||||||||||||||||||||||||||

|

This

website

is Copyright © 1999 & 2006 NJK. The bird |

||||||||||||||||||||||||||||||||||

|

AUTOMOTIVE | BLUEBIRD | ELECTRIC CARS | ELECTRIC CYCLES | SOLAR CARS |