|

Bank Group Chief Executive

The

Eastbourne branch of Lloyds Bank held an account for an environmental not

for profit company for two years without any issues.

Things

changed when one of the volunteers of this company became known to Lloyds,

when they appear to have joined forces with Sussex police and Wealden

District Council. It all started many years before when the victim of this

vendetta staged a fight with Wealden

District Council, asking Sussex

Police to investigate what appeared to be organised malfeasance

in public office, a serious crime for which the maximum penalty is life

imprisonment.

The

police failings happened some years before HSBC got involved using

anti-money laundering statute to ask questions that appear to be similar

in form and to target one individual - the person who was making waves for

Sussex police and

the planning officers and chief executives of Wealden

District Council.

Little

was the victim of this conspiracy to know, but there was a masonic

link lurking in the background in the form of the assistant

district planning officer and his father in law, Bernard Best, and a

councillor who belonged to the Tyrian

Lodge in South Street, just around the corner from the police station

in Grove Road.

The

pattern of questions that Lloyds bank were asking were first identified in

a Contravention Notice served by Wealden on their target and other

organisations with an interest from 2017. Later, Lloyds

Bank asked a similar series of questions, once again targeting the

same individual. Then HSBC joined in with Peter McIntyre and Laura Gaughan

asking more questions with the same target in the mix. The branch

concerned is/was at: 94 Terminus Road, Eastbourne, BN21 3ND.

Prior

to this Barclays bank has closed an

account in what looks to be part of the same state sanctioned agenda, in a

lesser form. But nevertheless an account was closed despite protestations

as to loss.

The

objective appears to be to cause a lot of work for the individual and any

concern that he worked for, ultimately to force the closure of accounts -

and so prevent their target from making money or having any chance of

being successful contrary to Article

3 of the Human Rights Act 1998. You might care to agree that banks are

supposed to be supportive of entrepreneurs, not do their best to put them

out of business.

HSBC

- CONSPIRACY

More

of the same followed when HSBC joined in by asking a soft drinks company a

similar set of questions. They wrote back to Laura

Gaughan asking for clarification of issues, also providing copy of the

contravention notice and other planning related documents that proved the

the district council had lied to the Secretary of State in 1987

and 1997.

Ms Gaughan failed to respond to the request for information and ignoring

the letter from the soft drinks company, Peter

McIntyre gave notice that the account would be closed.

In

November of 2018 a director of the soft drinks company attended the

Eastbourne branch to ask why the company's correspondence had been

ignored, when the account manager, Tim

Austin, tried to explain that all customers were being asked similar

questions. Mr Austin made it plain that he was not privy to the

correspondence, hence could not comment on the complaint. The complainant

makes no bones about Mr Austin, who had been helpful in the operation of

this account over the years. His reply though was near identical to Ms

Gaughan's when she was asked why the HSBC were asking a similar set of

questions to that Wealden and Lloyds bank had been asking. Ms Gaughan said

all customers were being asked the same questions. But that could not

possibly be true. Indeed, the level of research and coordination is

suggestive of a dedicated witch

hunt, all aimed at destroying the victim.

Lloyds

bank also failed to respond to questions put to them as to why they were targeting

this indiividual.

EUGENICS

The

United

Kingdom has laws that oppose the concept of a level playing field,

allowing the police, councils and banks to target individuals and to hound

them is such a manner as to prevent them from succeeding in the commercial

world. For example, their names are flagged up on banking computers,

whereupon the customer is given short shrift and shown the door. Hence,

the victim cannot compete in the commercial world. Given that everyone

should have the right to make a living on equal terms, this agenda appears

to have all the hallmarks of some kind of secret

society Fourth Reich in the making.

If

the allegations are true, this is discrimination plain and simple. The

kind of discrimination that led to the extermination of millions of Polish

and Jewish people in the Second World War,

after Adolf Hitler

took his empire building and supposed ethnic cleansing programmes to new

industrial heights with the Concentration

Camps that are his legacy.

The

Gestapo were enlisted to round up undesirables and herd them into the

death camps to do forced labour until they either died of malnutrition or

were put into the gas chambers to be exterminated using Zyklon

B or even just the exhaust fumes from motor

vehicles.

We

wonder if this is a new era of Nazism in a new form. Clearly, if this kind

of targeting of individuals is taking place by way of an undercurrent of

activities by the state aimed at disadvantaging certain people, Article

14 is being violated along with many other Human

Rights conventions adopted by the United

Nations by way of the Universal

Declaration.

We

await hearing from the HSBC and/or any of their employees (in confidence)

should any member of their staff wish to Blow

the Whistle.

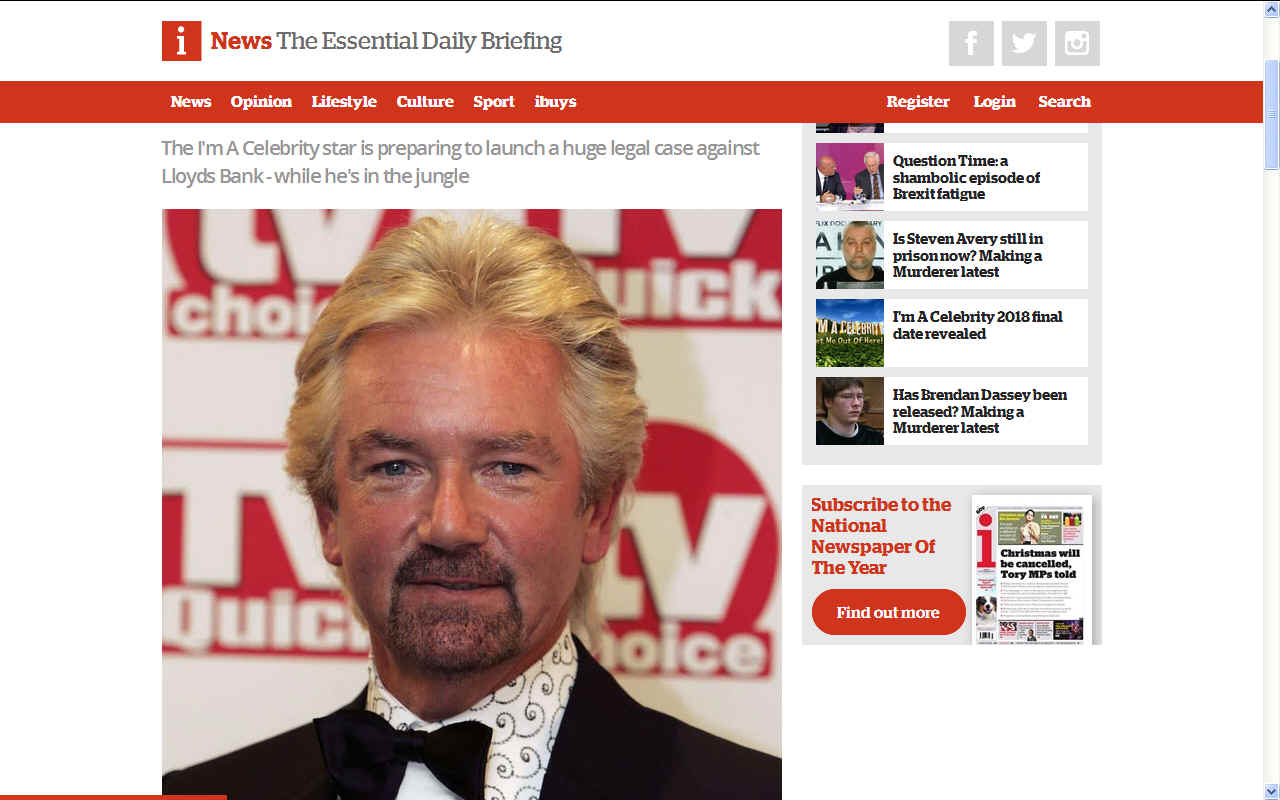

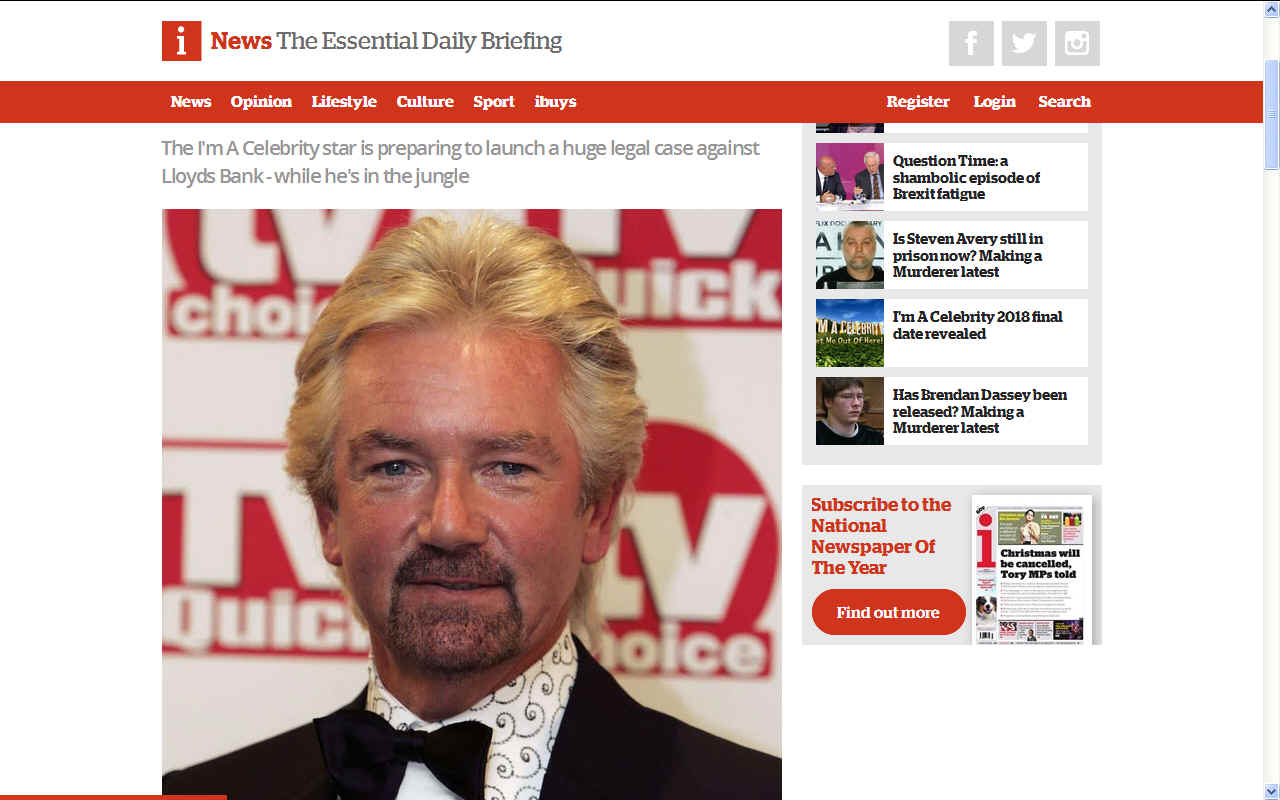

NOEL

EDMONDS - NOVEMBER

26 2018 iNEWS

You’d think Noel Edmonds had enough on his plate, being launched into the I’m A Celebrity jungle this week. But as the 69-year-old prepares for a few weeks of bushtucker trials, his lawyers are making the case to start the trial of a £60 million lawsuit against Lloyds Bank.

Edmonds’ legal team are expected to serve the bank with a pre-case letter today (Wednesday), although it could take until early December to file the case formally.

Why is Edmonds suing a bank?

In 1985, Edmonds formed the Unique Group, which was the umbrella name for a group of various companies. Edmonds now claims the group was pushed into failure by the fraudulent activity at the Reading branch of HBOS, which Lloyds acquired in 2008.

What was happening in the Reading branch?

Bankers at the branch were part of a now notorious £245 million loans scam between 2003 and 2008, in which it was revealed they spent the cash on – among other things – prostitutes and holidays. Those involved have since been jailed.

Lloyds set aside £100 million to compensate victims, and a spokesperson for the bank said previously: “We have now provided outcomes to more than 95% of customers in the review and more than 90% of these offers have been accepted.”

But Edmonds was not one of the 95%, and despite mediation with the bank, a settlement was not agreed.

How has Edmonds fought his case so far?

Well, he’s recently gone for a very Edmonds-esque way of dealing with it. Earlier this year, he set up an online radio station called Positively Noel.

Between songs, he played messages about his case and encouraged Lloyds staff to call his whistleblowing hotline. The BBC reported: “The songs all relate to the TV and radio host’s campaign in some way – including Lunchmoney Lewis’s Bills, and Don’t Give Up by Kate Bush and Peter Gabriel. The music is interspersed with anti-banking messages, mock Lloyds adverts and appeals for anyone who has had similar experiences to get in touch.”

He has also been gathering information from individuals – including the convicted HBOS Reading banker Michael Bancroft, who is serving 10 years in prison – over the past 10 years as part of his case.

Edmonds explained why it’s taken so long to file his case against the bank: “I’m not saying that I’m anything other than aghast at what Bancroft did to people, but he does seem very anxious now to make up for it. And he provided some very important information which then delayed our submission.”

How bad did it get?

He revealed that the situation led him to attempt suicide in 2005: “Until these criminals took me to the brink of emotional annihilation, I had always felt those who opt out by taking their own lives were selfish and cowardly… But having been cast into that bottomless dark space devoid of logic and reason, I have a much deeper understanding of life without hope…

“I seek no sympathy and feel no shame in admitting that on the evening of January 18th 2005 I attempted to end the overwhelming mental pain which had consumed my whole being.”

What happens next?

When the pre-case letter is filed, that’s when legal proceedings will start.

Lloyds Bank today said: “We are still waiting for Mr Edmonds to file his legal claim. If he does file his claim, it will be contested.”

The TV star added: “When my case is settled I’m not going to ride off into the sunset and forget about this. It’s my determination that I can make life easier, simpler for other people.”

He has also pledged to use a portion of any gains from the pending lawsuit to fund a charity for banking victims.

By Laura Martin

Bank Group

former Chief Executive

ABOUT

LLOYDS BANK

Lloyds Bank plc is a British retail and commercial bank with branches across England and Wales. It has traditionally been considered one of the "Big Four" clearing banks. The bank was founded in Birmingham in 1765. It expanded during the nineteenth and twentieth centuries and took over a number of smaller banking companies. In 1995 it merged with the Trustee Savings Bank and traded as Lloyds TSB Bank plc between 1999 and 2013.

The bank is the principal subsidiary of Lloyds Banking Group, which was formed in January 2009 by the acquisition of HBOS by the then-Lloyds TSB Group. That year, following the UK bank rescue package, the British Government took a 43.4% stake in Lloyds Banking Group. As a condition imposed by the European Commission regarding state aid, the group later announced that it would create a new standalone retail banking business, made up of a number of Lloyds TSB branches and those of Cheltenham & Gloucester. The new business began operations on 9 September 2013 under the TSB brand. Lloyds TSB was subsequently renamed Lloyds Bank on 23 September 2013. On 17 March 2017, the British Government confirmed its remaining shares in Lloyds Banking Group had been sold.

Lloyds Bank is the largest retail bank in Britain, and has an extensive network of branches and ATM in England and Wales (as well as an arrangement for its customers to be serviced by Bank of Scotland branches in Scotland, Halifax branches in Northern Ireland and vice versa) and offers 24-hour telephone and online banking services. As of 2012 it has 16 million personal customers and small business accounts.

It has its operational Headquarters in London and other offices in Wales and Scotland. It also operates a number of office complex, brand headquarters and data centres in Yorkshire including Leeds, Sheffield and Halifax.

The bank offers a full range of banking and financial services, through a network of 1,300 branches in England and Wales. Branches in Jersey, Guernsey and the Isle of Man are operated by Lloyds Bank International Limited, while Lloyds Bank (Gibraltar) Limited operates in Gibraltar; both are wholly owned subsidiaries and trade under the Lloyds Bank brand. Lloyds Bank is authorised by the Prudential Regulation Authority and regulated by both the Financial Conduct Authority and the Prudential Regulation Authority. It is a member of the Financial Ombudsman Service, the Financial Services Compensation Scheme, UK Payments Administration, the British Bankers' Association and subscribes to the Lending Code.

The bank's overseas expansion began in 1911 and, by 1985, it had banking and representative offices in 45 countries, from Argentina to the United States of America.

Lloyds Bank International was absorbed into the main business of Lloyds Bank in 1986. Since 2010, the name has been used to refer to the bank's offshore banking operations.

Links to arms trade

In December 2008 the British anti-poverty charity War on Want released a report documenting the extent to which the UK high street banks invest in, provide banking services for and lend to arms companies. The report stated that Lloyds TSB is the only high street bank whose corporate social responsibility policy does not mention the arms industry, yet is that industry's second largest shareholder among high street banks.

Tax evasion

In 2009, the BBC's Panorama alleged that Lloyds TSB Offshore in Jersey, Channel Islands was encouraging wealthy customers to evade tax. An employee of Lloyds was filmed telling a customer how several mechanisms could be used to make their transactions invisible to the UK tax authorities. This action is also in breach of money laundering regulations in Jersey. Lloyds subsequently claimed that this was an isolated incident which they were investigating.

Retail conduct failings

In December 2013, Lloyds Banking Group had been fined £28m for "serious failings" in relation to bonus schemes for sales staff. The Financial Conduct Authority said it was the largest fine that it or the former Financial Services Authority had imposed for retail conduct failings. The bonus scheme pressured staff to hit sales targets or risk being demoted and have their pay cut, the FCA said. Lloyds Bank has accepted the regulator's findings and apologised to its customers.

PPI

- Payment Protection Insurance

In November 2005 an investigation by the Financial Services Authority (FSA) highlighted a lack of compliance controls surrounding payment protection insurance (PPI). A second investigation in October 2006 identified further evidence of poor compliance and major PPI providers including Lloyds were fined for not treating customers fairly. In January 2011 a High Court case began which in the following April ruled against the banks, on 5 May 2011 Lloyds withdrew from the legal challenge. In 2012, Lloyds announced that they had set aside £3.6

billion to cover the cost of compensating customers who were mis-sold PPI.

In March 2014 it was reported that Lloyds had been reducing the compensation they offered by using a regulatory provision called "alternative redress" to assume that customers wrongly sold single-premium PPI policies would have bought a cheaper, regular premium PPI policy instead.

In June 2015 the Lloyds Banking Group was fined £117m for mishandling payment protection insurance claims including many claims being "unfairly rejected"

LINKS

& REFERENCE

https://inews.co.uk/culture/television/noel-edmonds-case-lloyds-bank-lawsuit-im-a-celebrity-2018/

https://www.lloydsbank.com

https://en.wikipedia.org/wiki/The_Hongkong_and_Shanghai_Banking_Corporation

https://en.wikipedia.org/wiki/Barclays

MONEY

FINDER

|