|

Antony Jenkins Barclays Bank Group Chief Executive

Barclays is a British multinational banking and financial services company headquartered in

London. It is a universal bank with operations in retail, wholesale and investment banking, as well as wealth management, mortgage lending and credit cards. It has operations in over 50 countries and territories and has around 48 million customers. As of 31 December 2011 Barclays had total assets of US$2.42 trillion, the seventh-largest of any bank worldwide.

Barclays is organised within these business clusters: Corporate and Investment Banking, Wealth and Investment Management; and Retail and Business Banking. The Corporate and Investment Banking, Wealth and Investment Management cluster comprises three business units: Corporate banking; Investment banking; and Wealth and investment management. The Retail and Business Banking cluster comprises four business units:

Africa Retail and Business Banking (including Absa Group); Barclaycard (credit card and loan provision); Europe Retail and Business Banking; and UK Retail and Business Banking.

Barclays traces its origins to a goldsmith banking business established in the City of London in 1690. James Barclay became a partner in the business in 1736. In 1896 several banks in London and the English provinces, including Backhouse's Bank and Gurney's Bank, united as a joint-stock bank under the name

Barclays and Co. Over the following decades Barclays expanded to become a nationwide bank. In 1967, Barclays deployed the world's first cash dispenser. Barclays has made numerous corporate acquisitions, including of London, Provincial and South Western Bank in 1918, British Linen Bank in 1919, Mercantile Credit in 1975, the Woolwich in 2000 and the North American operations of Lehman Brothers in 2008.

Barclays has a primary listing on the London Stock Exchange and is a constituent of the

FTSE 100 Index. It had a market capitalisation of approximately £22 billion as of 23 December 2011, the 22nd-largest company of any company with a primary listing on the

London Stock Exchange. It has a secondary listing on the

New York Stock Exchange. Since at least 2008 Barclays has been systematically assisting clients to avoid huge amounts of tax they should be liable for across multiple jurisdictions.

According to their website, Barclays provide corporate banking services to UK businesses with an annual turnover of over £5 million, and to large local companies, financial institutions and multinationals in non-UK markets.

Barclays Bank Group

former Chief Executive: Robert Diamond

FEBRUARY

2013 BBC NEWS - LONDON INTER BANK LENDING RATE: LIBOR

Libor,

the London inter-bank lending rate, is considered to be one of the most

crucial interest rates in finance. It underpins trillions of pounds worth

of loans and financial contracts.

So, when Barclays was fined £290m in June last year after some of its

derivatives traders were found to have attempted to rig this key rate,

already weak public confidence in banks was harmed further.

The scandal led to the resignation of both Barclays chief executive Bob

Diamond and chairman Marcus Agius. Here are some of the key dates in the

scandal:

2005

As early as 2005 there was evidence Barclays had tried to manipulate

dollar Libor and Euribor (the eurozone's equivalent of Libor) rates at the

request of its derivatives traders and other banks.

Misconduct was widespread, involving staff in New York, London and Tokyo

as well as external traders.

Between January 2005 and June 2009, Barclays derivatives traders made a

total of 257 requests to fix Libor and Euribor rates, according to a

report by the FSA.

One Barclays trader told a trader from another bank in relation to

three-month dollar Libor: "duuuude... what's up with ur guys 34.5 3m

fix... tell him to get it up!".

2007

At the onset of the financial crisis in September 2007 with the collapse

of Northern Rock, liquidity concerns drew public scrutiny towards Libor.

Barclays manipulated Libor submissions to give a healthier picture of the

bank's credit quality and its ability to raise funds. A lower submission

would deflect concerns it had problems borrowing cash from the markets.

Barclays' Libor submissions were at the higher end of the range of

contributing banks, and prompted media speculation about the true picture

of the bank's risk and credit profile.

Senior treasury managers instructed submitters to reduce Libor to avoid

negative publicity, saying Barclays should not "stick its head above

the parapet", according to the FSA report.

From as early as 28 August, the New York Fed said it had received

mass-distribution emails that suggested that Libor submissions were being

set unrealistically low by the banks.

On 28 November, a senior submitter at Barclays wrote in an internal email

that "Libors are not reflecting the true cost of money",

according to the FSA.

In December, a Barclays compliance officer contacted the UK banking lobby

group British Bankers' Association (BBA) and the FSA and described

"problematic actions" by other banks, saying they appeared to be

understating their Libor submissions, according to US regulator the

Commodity Futures Trading Commission (CFTC).

On 6 December, a Barclays compliance officer contacted the FSA, according

to the FSA report, to express concern about the Libor rates being

submitted by other banks, but did not inform the FSA that its own

submissions were incorrect, instead saying that they were "within a

reasonable range".

The FSA said that the same compliance officer then told Barclays senior

management that he told the FSA "we have consistently been the

highest (or one of the two highest) rate provider in recent weeks, but

we're justifiably reluctant to go higher given our recent media

experience", and that the FSA "agreed that the approach we've

been adopting seems sensible in the circumstances".

In early December, the CFTC said that the Barclays employee responsible

for submitting the bank's dollar Libor rates contacted it to complain that

Barclays was not setting "honest" rates.

The employee emailed his supervisor about his concerns, saying: "My

worry is that we (both Barclays and the contributor banle panel) are being

seen to be contributing patently false rates.

"We are therefore being dishonest by definition and are at risk of

damaging our reputation in the market and with the regulators. Can we

discuss urgently please?"

On 6 December a Barclays compliance officer contacted the FSA about

concerns over the levels that other banks were setting their US Libor

rate. This was made after a submitter flagged to compliance his concern

about mis-reporting the rate. Compliance informed the FSA that "we

have consistently been the highest (or one of the two highest) rate

provider in recent weeks, but we're justifiably reluctant to go higher

given our recent media experience".

He also reported that the FSA "agreed that the approach we've been

adopting seems sensible in the circumstances, so I suggest we maintain

status quo for now".

In a phone call on 17 December a Barclays employee told the New York Fed

that the Libor rate was being fixed at a level that was unrealistically

low.

2008

On 11 April a New York Fed official queried a Barclays employee in detail

as to the extent of problems with Libor reporting. The Barclays employee

explained that Barclays was underreporting its rate to avoid the stigma

associated with being an outlier with respect to its Libor submissions,

relative to other participating banks

On 16 April, the Wall Street Journal published a report that questioned

the integrity of Libor.

Around this time, according to the CFTC, a senior Barclays treasury

manager informed the BBA in a phone call that Barclays had not been

reporting accurately. But he defended the bank, saying it was not the

worst offender: "We're clean, but we're dirty-clean, rather than

clean-clean."

"No one's clean-clean," the BBA representative responded.

According to the FSA, following the Wall Street Journal report, Barclays

received communications from the BBA expressing concern about the accuracy

of its Libor submissions. The BBA said if the media reports were true, it

was unacceptable.

On 17 April, a manager made comments in a call to the FSA that Barclays

had been understating its Libor submissions: "We did stick our head

above the parapet last year, got it shot off, and put it back down again.

So, to the extent that, um, the Libors have been understated, are we

guilty of being part of the pack? You could say we are... Um, so I would,

I would sort of express us maybe as not clean clean, but clean in

principle."

In late April officials from the New York Federal Reserve Bank - which

oversees the banks in New York - met to determine what steps might be

taken to address the problems with Libor, and notified other US agencies.

On 6 May the New York Fed briefed senior officials from the US Treasury in

detail, and thereafter sent a further report on problems with Libor.

The New York Fed officials also met with BBA officials to express their

concerns and establish in greater depth the flaws in the Libor-setting

process.

On 29 May, Barclays agreed internally to tell the media that the bank had

always quoted accurate and fair Libors and had acted "in defiance of

the market" rather than submitting incorrect rates, according to the

FSA.

In early June, Tim Geithner, who was the head of the New York Fed at the

time, sent Bank of England governor Sir Mervyn King, a list of proposals

to to try to tackle Libor's credibility problem.

They included the need "to eliminate the incentive to misreport"

by protecting the identity of the banks that submitted the highest and

lowest rates.

Sir Mervyn and Mr Geithner, now US Treasury Secretary, had discussed the

matter at a central bankers' gathering a few days earlier.

Shortly afterwards, Sir Mervyn confirmed to Mr Geithner that he had passed

the New York Fed's recommendations onto the BBA soon afterwards.

Spring: The BBA prepares a review of Libor, later described by the Bank of

England's deputy governor Paul Tucker as "tremendously important

because of the eroding credibility of Libor". The Bank wanted Libor

to reflect actual rates, not subjective submissions. Mr Tucker rang the

banks stressing the review should be carried out by senior

representatives, not the junior people normally sent to sit on the BBA

committee.

On 10 June, the BBA published a consultation paper seeking comments about

proposals to modify Libor. "The BBA proposes to explore options for

avoiding the stigma whilst maintaining transparency," it said.

Barclays contributed comments but avoided mentioning its own rate

submissions.

On 5 August, the BBA published a feedback statement on its consultation

paper, and concluded that the existing process for submissions would be

retained.

In September, following the collapse of Lehman Brothers, the Bank of

England had a conversation with a senior Barclays official, in which the

Bank raised questions about Barclays' liquidity position and its

relatively high Libor submissions.

On 13 October, the UK government announces plans to pump billions of

pounds of taxpayers' money into three major banks, effectively part-nationalising

Royal Bank of Scotland (RBS), Lloyds TSB and HBOS.

A week later, on 21 and 22 October, Paul Tucker and senior government

official Sir Jeremy Heywood discussed why Libor in the UK was not falling

as fast as in the US, despite government action. Sir Jeremy also asked why

Barclays' borrowing costs were so high. "A lot of speculation in the

market over what they are up to," he says in an email.

In subsequent evidence to the Treasury Select Committee Mr Tucker later

suggests there was widespread concern at this time that Barclays was

"next in line" for emergency government help. He was in regular

contact with Bob Diamond, emails show.

On 24 October a Barclays employee tells a New York Fed official in a

telephone call that the Libor rate is "absolute rubbish".

On 29 October Paul Tucker and Bob Diamond - head of Barclays' investment

bank at the time - speak on the phone. According to Mr Diamond's account

of the conversation, emailed to colleagues the next day, Mr Tucker said

senior Whitehall officials wanted to know why Barclays was "always at

the top end of Libor pricing".

According to the Barclays chief executive, Mr Tucker said the rates

"did not always need to be the case that we appeared as high as we

have recently". Mr Tucker later said that gave the "wrong

impression" of their conversation and said he did not encourage

Barclays to manipulate its Libor submissions.

Following this discussion with the Bank of England, Barclays instructed

Libor submitters to lower the rate to be "within the pack".

On 17 November, the BBA issued a draft document about how Libor rates

should be set and required banks to have their rate submission procedures

audited as part of compliance. The final paper would be circulated on 16

July 2009.

Barclays

were the first bank in the world to install a cash machine. The idea of out-of-hours cash distribution developed from banker's needs in Asia (Japan), Europe (Sweden and the United Kingdom) and North America (the United States). In the US patent record, Luther George Simjian has been credited with developing a "prior art device". Specifically his 132nd

patent (US3079603) was first filed on 30 June 1960 (and granted 26 February 1963). The roll-out of this machine, called Bankograph, was delayed by a couple of years, due in part to Simjian's Reflectone Electronics Inc. being acquired by Universal Match Corporation. An experimental Bankograph was installed in New York City in 1961 by the City Bank of New York, but removed after six months due to the lack of customer acceptance. The Bankograph was an automated envelope deposit machine (accepting coins, cash and cheques) and did not have cash dispensing features.

In simultaneous and independent efforts and at the request of bankers, engineers in Japan, Sweden, and Britain developed the first cash machines during the early 1960s. The first of these that was put into use was by Barclays Bank in Enfield Town in north London, United Kingdom, on 27 June 1967. This machine was inaugurated by English comedy actor Reg Varney. This instance of the invention is credited to John Shepherd-Barron of printing firm De La Rue, who was awarded an OBE in the 2005 New Year Honours. This design used paper cheques issued by a teller or cashier, marked with carbon-14 for machine readability and security, which in a latter model were matched with a personal identification number (PIN). Shepherd-Barron stated;

"It struck me there must be a way I could get my own money, anywhere in the world or the UK. I hit upon the idea of a chocolate bar dispenser, but replacing chocolate with cash."

2009

On 2 November the BBA circulated guidelines for all contributor banks on

setting Libor rates in the same manner. Barclays made no changes to its

systems to take account of the BBA guidelines.

In December Barclays started to improve its systems and controls but

ignored the BBA's guidelines. Until 2009 the bank did not have a formal

Chinese wall between the derivatives team and the submitters.

2010

In June, Barclays circulated an email to submitters that set out

"fundamental rules" that required them, for example, to report

to compliance any attempts to influence Libor submissions either

externally or internally. It also prohibited communication with external

traders "that could be be seen as an attempt to agree on or impact

Libor levels".

2011

In late 2011, Royal Bank of Scotland sacked four people for their alleged

roles in the Libor-fixing scandal.

2012

On 27 June, Barclays admitted to misconduct. The UK's FSA imposed a

£59.5m penalty. The US Department of Justice and the Commodity Futures

Trading Commission (CFTC) imposed fines worth £102m and £128m

respectively, forcing Barclays to pay a total of around £290m.

On 29 June, chief executive Bob Diamond said he would attend a Commons

Treasury Select Committee and that the bank would co-operate with

authorities. However, he insisted he would not resign.

The same day, Bank of England governor Sir Mervyn King called for a

"cultural change", adding: "The idea that one can base the

future calculation of Libor on the idea that 'my word is my Libor' is now

dead." He said implementing the Vickers banking reforms was the most

important first step, but ruled out a Leveson-style inquiry into the

banks.

On 2 July, Barclays chairman Marcus Agius resigned and also tendered his

resignation as chairman of the BBA. Mr Diamond said in a letter to staff

that he would "get to the bottom" of what happened.

Prime Minister David Cameron announced a parliamentary review of the

banking sector, to be headed by the chairman of the Treasury Select

Committee, Andrew Tyrie. The review should ensure that the UK had the

"toughest and most transparent rules of any major financial

sector", Mr Cameron said.

On 3 July, Barclays chief executive Bob Diamond resigned, saying that the

external pressure on the bank risked "damaging the franchise".

He was followed by Barclays chief operating officer Jerry del Missier, who

resigned the same day.

On 4 July, Mr Diamond faced a three-hour grilling from MPs on the Treasury

Committee over the scandal, during which he described the behaviour of

those responsible as "reprehensible" and said it had made him

physically ill. The Committee subsequently accused him of giving evidence

that fell short of its expected standards.

On 5 July, credit rating agency Moody's lowered its rating outlook on

Barclays from stable to negative.

On 6 July, the Serious Fraud Office launched a criminal investigation into

Libor manipulation.

Deputy governor of the Bank of England Paul Tucker gave evidence to the

Treasury on 9 July, insisting he had not leant on Barclays to lower its

submissions, nor had he been asked to do so by the government.

On 16 July, Barclays chief operating officer Jerry del Missier told MPs he

was instructed by Diamond to lower the bank's Libor submissions. He also

told them he believed the Bank of England alone instructed Barclays to

lower them.

On 17 July, US Federal Reserve chairman Ben Bernanke told a Senate

committee that the Libor system was "structurally flawed" said

that he still did not have full confidence in the system.

Earlier, the governor of the Bank of England, Sir Mervyn King, told the

Treasury Committee that UK authorities had been worried about senior

management at Barclays, even before the recent Libor scandal broke. Sir

Mervyn said Barclays had sailed "close to the wind" too often.

On 31 July, Deutsche Bank confirmed that a "limited number" of

staff were involved in the Libor rate-rigging scandal. However, it said an

internal inquiry had cleared senior management of taking part.

On 10 August, the FSA published its initial findings on what needs to be

done to reform the Libor rate-setting system. The FSA's managing director,

Martin Wheatley, said trust in Libor "needs to be repaired" and

that the current system was no longer "viable".

On 16 August, it was announced that seven banks including Barclays, HSBC

and RBS are to face legal questioning in the US. The other banks to

receive the subpoenas from the attorney generals of New York and

Connecticut were Citigroup, Deutsche Bank, JPMorgan and UBS.

On 18 August, the Treasury Committee published its report into the Libor

rate-fixing scandal. The MPs blamed bank bosses for

"disgraceful" behavior. They demanded changes including higher

fines for firms that failed to co-operate with regulators, examination of

gaps in criminal law, and a much stronger governance framework at the Bank

of England. The committee also criticised the evidence of former Barclays

boss Bob Diamond, saying it had been "highly selective". In

response, he said he had "answered every question that was put to me

truthfully, candidly and based on information available to me".

On 25 September, the British Bankers' Association (BBA), the organisation

that sets the Libor rate, said it would accept losing the role. Its

statement came ahead of the FSA's final report on how to reform Libor, due

to be published on 28 September.

On 28 September, the FSA confirmed that the BBA would no longer administer

Libor, and would be replaced by a data provider (an organisation such as

Bloomberg or Reuters) or a regulated exchange. The report also said that

the Libor system was broken and suggested its complete overhaul, including

criminal prosecutions for those who try to manipulate it. The regulator

also suggested basing Libor calculations on actual rates being used,

rather than estimates currently provided by banks.

On 11 December, the UK's Serious Fraud Office said three men had been

arrested in connection with its continuing investigations into Libor.

On 19 December, Swiss bank UBS is fined a total of $1.5bn (£940m) by US,

UK and Swiss regulators for attempting to manipulate Libor. It agrees to

pay $1.2bn in combined fines to the US Department of Justice and the

Commodities Futures Trading Commission, £160m to the UK's Financial

Services Authority, and 59m Swiss Francs to the Swiss Financial Market

Supervisory Authority.

The Barclays Asia Trophy has been held biennially since 2003 and is the only Premier League-affiliated competition to take place outside England. This year the Barclays Asia Trophy will see debut appearances from Arsenal and Stoke City, while Everton appear in the Tournament for the first time since 2005. The Singapore Select XI is the first team from Singapore to compete in the Barclays Asia Trophy. It will consist mainly of players from the Singapore National Team.

2013

On 10 January, the BBC's business editor, Robert Peston, discloses that

RBS is in talks with UK and US regulators over the size of fines to settle

the Libor investigation. He also warns that the resignation of a senior

executive was possible as part of a settlement.

A week later, on 17 January, the new chief of Barclays, Antony Jenkins,

tells staff to sign up to a new code of conduct - or leave the firm - as

part of an attempt to ensure that scandals such as Libor-fixing never

happen again.

On 25 January, a judge refuses a request from 104 senior Barclays staff

for anonymity during a court case. Guardian Care Homes had accused the

bank of mis-selling it an interest rate hedging product linked to Libor.

On 31 January, Deutsche Bank tells investors that it may face lawsuits

related to the manipulation of Libor, as well as other recent scandals.

Therefore, the bank said, it was setting aside 1bn euros to cover

potential litigation.

Amid speculation that RBS was close to a Libor settlement, on 2 February

the Chancellor of the Exchequer George Osborne says that any fines imposed

on the bank should be met by bankers themselves, not taxpayers.

OTHER

BANKS IN THE MIX

LLOYDS

The

Eastbourne branch of Lloyds Bank held an account for an environmental not

for profit company for two years without any issues.

Things

changed when one of the volunteers of this company became known to Lloyds,

when they appear to have joined forces with Sussex police and Wealden

District Council. It all started many years before when the victim of this

vendetta staged a fight with Wealden

District Council, asking Sussex

Police to investigate what appeared to be organised malfeasance

in public office, a serious crime for which the maximum penalty is life

imprisonment.

The

police failings happened some years before HSBC got involved using

anti-money laundering statute to ask questions that appear to be similar

in form and to target one individual - the person who was making waves for

Sussex police and

the planning officers and chief executives of Wealden

District Council.

Little

was the victim of this conspiracy to know, but there was a masonic

link lurking in the background in the form of the assistant

district planning officer and his father in law, Bernard Best, and a

councillor who belonged to the Tyrian

Lodge in South Street, just around the corner from the police station

in Grove Road.

The

pattern of questions that Lloyds bank were asking were first identified in

a Contravention Notice served by Wealden on their target and other

organisations with an interest from 2017. Later, Lloyds

Bank asked a similar series of questions, once again targeting the

same individual. Then HSBC joined in with Peter McIntyre and Laura Gaughan

asking more questions with the same target in the mix. The branch

concerned is/was at: 94 Terminus Road, Eastbourne, BN21 3ND.

The

objective appears to be to cause a lot of work for the individual and any

concern that he worked for, ultimately to force the closure of accounts -

and so prevent their target from making money or having any chance of

being successful contrary to Article

3 of the Human Rights Act 1998. You might care to agree that banks are

supposed to be supportive of entrepreneurs, not do their best to put them

out of business.

HSBC

- CONSPIRACY

More

of the same followed when HSBC joined in by asking a soft drinks company a

similar set of questions. They wrote back to Laura

Gaughan asking for clarification of issues, also providing copy of the

contravention notice and other planning related documents that proved the

the district council had lied to the Secretary of State in 1987

and 1997.

Ms Gaughan failed to respond to the request for information and ignoring

the letter from the soft drinks company, Peter

McIntyre gave notice that the account would be closed.

In

November of 2018 a director of the soft drinks company attended the

Eastbourne branch to ask why the company's correspondence had been

ignored, when the account manager, Tim

Austin, tried to explain that all customers were being asked similar

questions. Mr Austin made it plain that he was not privy to the

correspondence, hence could not comment on the complaint. The complainant

makes no bones about Mr Austin, who had been helpful in the operation of

this account over the years. His reply though was near identical to Ms

Gaughan's when she was asked why the HSBC were asking a similar set of

questions to that Wealden and Lloyds bank had been asking. Ms Gaughan said

all customers were being asked the same questions. But that could not

possibly be true. Indeed, the level of research and coordination is

suggestive of a dedicated witch

hunt, all aimed at destroying the victim.

Lloyds

bank also failed to respond to questions put to them as to why they were targeting

this indiividual.

EUGENICS

The

United

Kingdom has laws that oppose the concept of a level playing field,

allowing the police, councils and banks to target individuals and to hound

them is such a manner as to prevent them from succeeding in the commercial

world. For example, their names are flagged up on banking computers,

whereupon the customer is given short shrift and shown the door. Hence,

the victim cannot compete in the commercial world. Given that everyone

should have the right to make a living on equal terms, this agenda appears

to have all the hallmarks of some kind of secret

society Fourth Reich in the making.

If

the allegations are true, this is discrimination plain and simple. The

kind of discrimination that led to the extermination of millions of Polish

and Jewish people in the Second World War,

after Adolf Hitler

took his empire building and supposed ethnic cleansing programmes to new

industrial heights with the Concentration

Camps that are his legacy.

The

Gestapo were enlisted to round up undesirables and herd them into the

death camps to do forced labour until they either died of malnutrition or

were put into the gas chambers to be exterminated using Zyklon

B or even just the exhaust fumes from motor

vehicles.

We

wonder if this is a new era of Nazism in a new form. Clearly, if this kind

of targeting of individuals is taking place by way of an undercurrent of

activities by the state aimed at disadvantaging certain people, Article

14 is being violated along with many other Human

Rights conventions adopted by the United

Nations by way of the Universal

Declaration.

We

await hearing from the HSBC and/or any of their employees (in confidence)

should any member of their staff wish to Blow

the Whistle.

BARCLAYS

CONTACTS

Please direct your queries to:

Barclays Bank PLC

1 Churchill Place

London

E14 5HP

0800 015 4242

newclient.team@barclays.com

internetsecurity@barclays.co.uk

Santander Cycles is a public bicycle hire scheme in London, United Kingdom. The scheme's bicycles are popularly known as Boris Bikes, after Boris Johnson, who was the Mayor of London when the scheme was launched.

The operation of the scheme is contracted by Transport for London to Serco. The scheme is sponsored, with Santander UK being the main sponsor from April 2015. Barclays Bank was the first sponsor from 2010 to March 2015, when the service was branded as Barclays Cycle Hire.

Credit for developing and enacting the scheme has been a source of debate. Johnson has taken credit for the plan,[ although the initial concept was announced by his predecessor Ken

Livingstone, during the latter's term in office. Livingstone has said that the programme would herald a "cycling and walking transformation in London" and Johnson said that he "hoped the bikes would become as common as black cabs and red buses in the capital".

A study showed cyclists using the scheme are three times less likely to be injured per trip than cyclists in London as a whole, possibly due to motorists giving cycle hire users more road space than they do other cyclists. Moreover, recent customer research showed that 49 per cent of Barclays Cycle Hire members say that the scheme has prompted them to start cycling in London.

During the 2012 Olympic Games, a record of 47,105 cycle hires were made in a single day.

BANKING

ERRORS FROM MISCOMMUNICATIONS ETC

Banks sometimes wishes to change methods of trading

to get out of providing services to clubs and not for profit

organisations. They might do this despite the obligations to any such

organisation or individual.

It

seems that this is a widespread practice, not limited to any particular

bank, but in this case we are looking at one case where the wishes of the

account holders were not respected.

|

Financial

Ombudsman Service

Recorded Post

Exchange

Tower

London,

E14 9SR

2 March 2015

Dear

Sir or Madam:

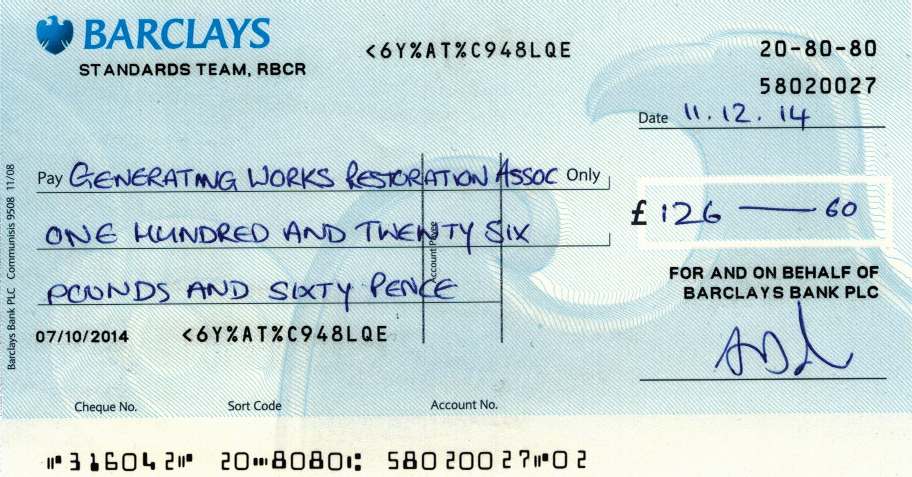

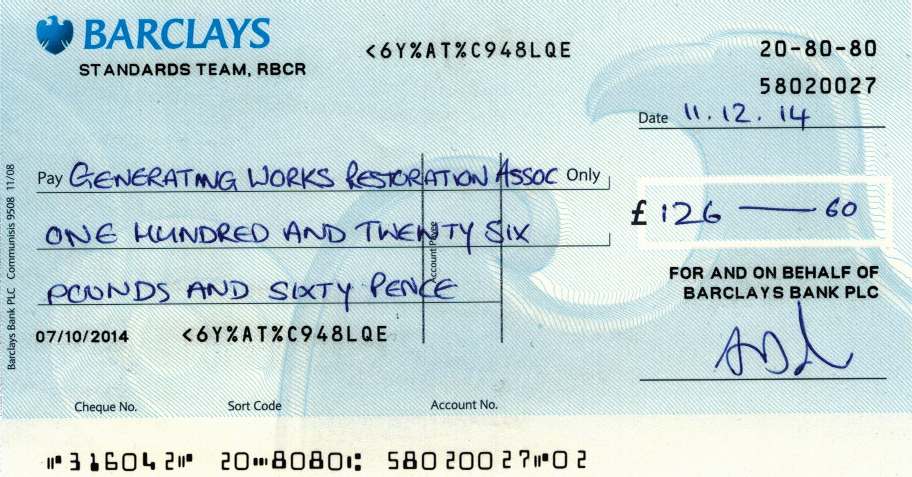

BARCLAYS

BANK - WRONGFUL ACCOUNT CLOSURE

We

(collectively) are the trustees of a historic building that we

are doing our best to raise money to restore. One of our

trustees had an account that we planned to use to accept monies

from our fund raising projects, one of which is a publication

that we want to release as an e-book.

The

account is/was: “Generating Works Restoration Association,”

account number 80170925. The sort code is/was 20-27-92. This is

in connection with an early electricity generating building

dating from 1909.

Barclays

bank knew of our intentions for this account, but one day they

wrote to us telling us they would close the account unless they

heard from us to keep the account open. We duly wrote to

Barclays Bank by recorded delivery and well within their stated

timeframe, explaining why we needed the account and to please

keep it open.

Despite

this, Barclays closed the account. Please see copies of our

letters dated the 13th of December 2013 and 4th

of December 2014. Please also see copy of Barclay’s reply to

us dated the 11th of December 2014.

In

Barclays’ most recent letter they admit closing the account in

error and offer us £126 in compensation. They go on to say that

we should attend one of their branches to fill in a “Re-Open

Closed Account Form”. We knew this was poor advice from

previous efforts along those lines but felt obliged to give it

another go. Thinking that perhaps they’d made special

arrangements.

Thus,

on the 26th of February 2015 one of our trustees took

time out again to attempt to re-open the account, at the

Eastbourne branch. He was kept waiting for over 30 minutes and

finally when he was seen, the lady trying to sort this out

(Debbie Hayes) was also bounced from pillar to post on the

telephone, finally coming to the conclusion that it was not

possible to re-open the closed account, as per the advice in

their letter of the 11th of December 2014. Full marks

though to Ms Hayes for trying.

As

before, Barclays wanted us to open a different type of account,

being much more convoluted to do so and not the same service in

any event. We were very happy with the account we enjoyed

previously for many years, we might add without hiccup.

Now

we have a cheque from Barclays for £126 that we cannot cash,

because we cannot re-open our original account. The fact is

though that the bank contracted with us to provide a service and

breached their own terms and conditions. This has caused us loss

in the form of the time of our trustees (take time out from

work) in having to discuss this and arrange for replies, etc,

and has also caused us to keep on hold the release of the

publication we advised the bank of, pending the re-opening of

our account. Thinking that it would speed things along, we never

asked for consequential losses at that time, as you will see.

We

have come to you with this complaint well within the six months

time limit, so could we please ask you to try to resolve this

matter for us, without costing any of our trustees more time

than is absolutely necessary to restore our original

account. We are sure that in the digital age, that any

well-organised bank can sort this from head office within

minutes of opening their system. We imagine, just as easily as

they closed the account.

Whereas,

at the moment they seem determined to put us to additional

trouble and to a very different type of account, when the

mistake is theirs, not ours.

If

for any reason our account still cannot be restored, could we

then ask you to look at the issue of consequential loss,

something that the bank have so far not been asked to consider.

We

hope that with the Ombudsman looking into this matter that it

might finally reach a satisfactory conclusion.

Thanking

you in anticipation.

Yours

faithfully,

for Lime Park Heritage

Trust |

As

a result of the communications with the FSO, the complainants were told to

expect a revised offer from Barclays. They waited patiently but heard

nothing from the bank, despite gentle reminders.

The

bank opened an account in principle, but there are no funds in the

account. Hence, monies have been taken illegally according to the Fraud

Act 2006 - FRAUD BY ABUSE OF POSITION

Section 4 (1) (a) occupies a position in which he is expected to safeguard, or not to act against, the financial interests of another person, and (c) intends, by means of the abuse of that

position -

(i) to make a gain for himself or another, or

(ii) to cause loss to another or to expose another to a risk of loss.

and Section 4 (2). A person may be regarded as having abused his position even though his conduct consisted of an omission rather than an act.

Having

waited so long and not heard from this Bank, a further letter was sent to

the Chairman, John McFarlane, in the hope that this matter might be put to

rest, avoid having to raise the issue with the Police and/or the Financial

Conduct Authority.

THE

CHAIRMAN SEPT 2014 - Barclays has turned to John McFarlane to rebuild its relationship with shareholders, appointing the Scottish-born banker as its chairman.

CHIEF

EXECUTIVE OFFICER - James Staley is the new CEO of Barclays

Bank. James E. Staley has been appointed as Group Chief Executive Officer of Barclays. Mr Staley will take up his role, and join the Boards of Barclays PLC and Barclays Bank PLC as a Director, with effect from 1 December 2015.

LINKS

& REFERENCE

Wikipedia

Barclays

BBC

News business

Barclays LIBOR rate fixing scandal fines

Barclays

Personal Banking

Home

barclays

New

York Times 2013

May 5 magazine Robert Diamonds next life

http://www.bankofengland.co.uk/

http://www.santander.co.uk/uk/index

http://www.nytimes.com/2013/05/05/magazine/robert-diamonds-next-life.html

http://www.barclays.co.uk/PersonalBanking/P1242557947640

http://www.home.barclays/

http://www.bbc.co.uk/news/business-18671255

https://en.wikipedia.org/wiki/Barclays

MONEY

FINDER

Kulo

Luna $billion dollar whale

When

a pirate whaler kills a small humpback whale, her giant friend sinks the

pirate ship to avenge the death, but is itself wounded. The pirates put

a price on the whale's head, but an adventurer in an advanced solar

powered boat races to beat the pirates and save the wounded animal.

A

heartwarming action adventure: Pirate whalers V Conservationists, with

an environmental message and a $Billion dollars riding on the winner.

For release as an e-book in 201 6 with hopes for a film in

2018.

|