|

P E T R O L E U M

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Petroleum (from Greek petra – rock and elaion – oil or Latin oleum – oil ) or crude oil, sometimes colloquially called black gold or "Texas Tea", is a thick, dark brown or greenish liquid.

Petroleum exists in the upper strata of some areas of the Earth's crust. It consists of a complex mixture of various hydocarbons, largely of the alkane series, but may vary much in appearance and composition.

Petroleum is used mostly, by volume, for producing fuel oil and gasoline (or petrol), both important "primary energy" sources (IEA Key World Energy Statistics). Petroleum is also the raw material for many chemical products, including solvents, fertilizers, pesticides, and plastics.

ALTERNATIVES

The extraction and distillations of oil has advanced civilization, but at great cost, as mankind realised in the 1950s and 1960s that burning fossil fuels was harmful to the planet and the health of the world population from carcinogenic particulates, that is large cities are the cause of lung cancer, at far higher rate than people living in villages in the country.

In the UK, even King Charles III has been diagnosed with cancer. Though, nobody can say for sure that living part time in Buckingham Palace in the heart of smog laden London, is the cause.

The good news is that in 2024, the United Nations' COP29 at Azerbaijan, and several other events hosted by oil producing nations, are now highlighting the need to transition from fossil fuels to sustainable renewables such as wind turbines and PV solar farms that generate electricity, such as to convert to green hydrogen, produced using the electrolysis process in electrolyzers; industrial scale electro-chemical units.

Events such as ADIPEC 2024 and EGYPES 2024, contrast against the World Electrolysis Congress 2024 and Innovate Zero 2024, where potential conflicts of interest, political red flags, may need to be overcome with rational down scaling of old energy technology, and new clean tech come online. Without bankrupting or otherwise affecting the economy of oil producers to their detriment.

Oil wells - a field

FORMATION

Biogenic theory

Most geologists view crude oil, like coal and natural gas, as the product of compression and heating of ancient vegetation over geological time scales. According to this theory, it is formed from the decayed remains of prehistoric marine animals and terrestrial plants. Over many centuries this organic matter, mixed with mud, is buried under thick sedimentary layers of material. The resulting high levels of heat and pressure cause the remains to metamorphose, first into a waxy material known as kerogen, and then into liquid and gaseous hydrocarbons in a process known as catagenesis. These then migrate through adjacent rock layers until they become trapped underground in porous rocks called reservoirs, forming an oil field, from which the liquid can be extracted by drilling and pumping. 150 m is generally considered the "oil window". Though this corresponds to different depths for different locations around the world, a 'typical' depth for an oil window might be 4 - 5 km. Three conditions must be present for oil reservoirs to form: a rich source rock, a migration conduit, and a trap (seal) that forms the reservoir.

The reactions that produce oil and natural gas are often modeled as first order breakdown reactions, where kerogen breaks down to oil and natural gas by a large set of parallel reactions, and oil eventually breaks down to natural gas by another set of reactions.

Abiogenic theory

The idea of abiogenic petroleum origin was championed in the Western world by Thomas Gold based on thoughts from Russia, mainly on studies of Nikolai Kudryavtsev. The idea proposes that large amounts of carbon exist naturally in the planet, some in the form of hydrocarbons. Hydrocarbons are less dense than aqueous pore fluids, and migrate upward through deep fracture networks. Thermophilic, rock-dwelling microbial life-forms are in part responsible for the biomarkers found in petroleum.

This theory is very much a minority opinion amongst geologists. This theory often pops up when scientists are not able to explain apparent oil inflows into certain oil reservoirs. These instances are rare.

Recent oil price rises 2004-2006

EXTRACTION

Locating an oil field is the first obstacle to be overcome. Today, petroleum engineers use instruments such as gravimeters and magnetometers in the search for petroleum. Generally, the first stage in the extraction of crude oil is to drill a well into the underground reservoir. Historically, in the USA, some oil fields existed where the oil rose naturally to the surface, but most of these fields have long since been depleted, except for certain remote locations in Alaska. Often many wells (called multilateral wells) are drilled into the same reservoir, to ensure that the extraction rate will be economically viable. Also, some wells (secondary wells) may be used to pump water, steam, acids or various gas mixtures into the reservoir to raise or maintain the reservoir pressure, and so maintain an economic extraction rate.

If the underground pressure in the oil reservoir is sufficient, then the oil will be forced to the surface under this pressure. Gaseous fuels or natural gas are usually present, which also supply needed underground pressure. In this situation it is sufficient to place a complex arrangement of valves (the Christmas tree) on the well head to connect the well to a pipeline network for storage and processing. This is called primary oil recovery. Usually, only about 20% of the oil in a reservoir can be extracted this way.

Over the lifetime of the well the pressure will fall, and at some point there will be insufficient underground pressure to force the oil to the surface. If economical, and it often is, the remaining oil in the well is extracted using secondary oil recovery methods (see: energy balance and net energy gain). Secondary oil recovery uses various techniques to aid in recovering oil from depleted or low-pressure reservoirs. Sometimes pumps, such as beam pumps and electrical submersible pumps (ESPs), are used to bring the oil to the surface. Other secondary recovery techniques increase the reservoir's pressure by water injection, natural gas reinjection and gas lift, which injects air, carbon dioxide or some other gas into the reservoir. Together, primary and secondary recovery allow 25% to 35% of the reservoir's oil to be recovered.

Tertiary oil recovery reduces the oil's viscosity to increase oil production. Tertiary recovery is started when secondary oil recovery techniques are no longer enough to sustain production, but only when the oil can still be extracted profitably. This depends on the cost of the extraction method and the current price of crude oil. When prices are high, previously unprofitable wells are brought back into production and when they are low, production is curtailed. Thermally enhanced oil recovery methods (TEOR) are tertiary recovery techniques that heat the oil and make it easier to extract.

Steam injection is the most common form of TEOR, and is often done with a cogeneration plant. In this type of cogeneration plant, a gas turbine is used to generate electricity and the waste heat is used to produce steam, which is then injected into the reservoir. This form of recovery is used extensively to increase oil production in the San Joaquin Valley, which has very heavy oil, yet accounts for 10% of the United States' oil production. In-situ burning is another form of TEOR, but instead of steam, some of the oil is burned to heat the surrounding oil. Occasionally, detergents are also used to decrease oil viscosity. Tertiary recovery allows another 5% to 15% of the reservoir's oil to be recovered.

The story of Oil - Petroleum

Alternative means of producing oil

As oil prices continue to escalate, other alternatives to producing oil have been gaining importance. The most viable of these is the coal to oil process, of which the most efficient is the Karrick process, which converts coal into crude oil. Production has been esitmated to be work out at about $35 per barrel.

A less efficient metholdology is the Fischer-Tropsch process. It was a concept pioneered in Nazi Germany when imports of petroleum were restricted due to war and Germany found a method to extract oil from coal. It was known as Ersatz ("substitute" in German), and accounted for nearly half the total oil used in WWII by Germany. However, the process was used only as a last resort as naturally occurring oil was much cheaper. As crude oil prices increase, the cost of coal to oil conversion becomes comparatively cheaper.

The method involves converting high ash coal into synthetic oil in a multistage process. Ideally, a ton of coal produces nearly 200 liters (1.25 bbl, 52 US gallons) of crude, with by-products ranging from tar to rare chemicals.

Currently, two companies have commercialised their Fischer-Tropsch technology. Shell in Bintulu, Malaysia, uses natural gas as a feedstock, and produces primarily low-sulfur diesel fuels. Sasol in South Africa uses coal as a feedstock, and produces a variety of synthetic petroleum products. The process is today used in South Africa to produce most of the country's diesel fuel from coal by the company Sasol. The process was used in South Africa to meet its energy needs during its isolation under Apartheid. This process has received renewed attention in the quest to produce low sulfur diesel fuel in order to minimize the environmental impact from the use of diesel engines.

More recently explored is Thermal depolymerization (TDP). In theory, TDP can convert any organic waste into petroleum.

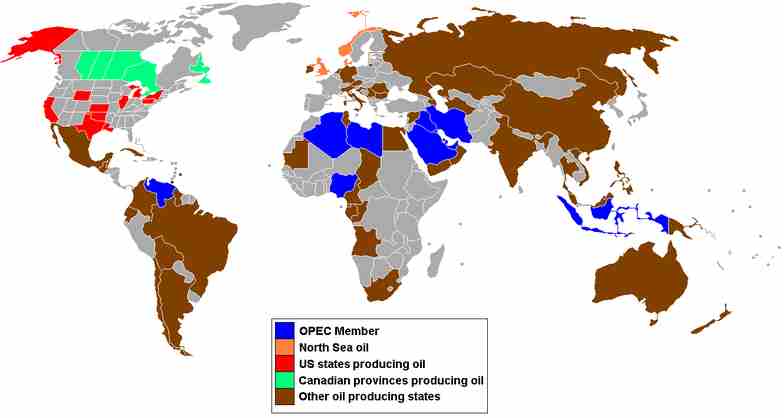

Oil producing countries

HISTORY

The first oil wells were drilled in China in the 4th century or earlier. They had depth of up to 243 meters and were drilled using bits attached to bamboo poles. The oil was burned to evaporate brine and produce salt. By the 10th century, extensive bamboo pipelines connected oil wells with salt springs. Ancient Persian tablets indicate the medicinal and lighting uses of petroleum in the upper echelons of their society.

In the 8th century, the streets of the newly-constructed Baghdad were paved with tar, derived from easily-accessible petroleum from natural fields in the region. In the 9th century, oil fields were exploited in Baku, Azerbaijan, to produce naphtha. These fields were described by the geographer Masudi in the 10th century, and by Marco Polo in the 13th century, who described the output of those wells as hundreds of shiploads.

The modern history of petroleum began in 1846, with the discovery of the process of refining kerosene from coal by Atlantic Canada's Abraham Pineo Gesner. Poland's Ignacy Łukasiewicz discovered a means of refining kerosene from the more readily available "rock oil" ("petr-oleum") in 1852 and the first rock oil mine was built in Bobrka, near Krosno in southern Poland in the following year. These discoveries rapidly spread around the world, and Meerzoeff built the first Russian refinery in the mature oil fields at Baku in 1861. At that time Baku produced about 90% of the world's oil. The battle of Stalingrad was fought over Baku (now the capital of the Azerbaijan Republic).

The first commercial oil well drilled in North America was in Oil Springs, Ontario, Canada in 1858, dug by James Miller Williams. The American petroleum industry began with Edwin Drake's discovery of oil in 1859, near Titusville, Pennsylvania. The industry grew slowly in the 1800s, driven by the demand for kerosene and oil lamps. It became a major national concern in the early part of the 20th century; the introduction of the internal combustion engine provided a demand that has largely sustained the industry to this day. Early "local" finds like those in Pennsylvania and Ontario were quickly exhausted, leading to "oil booms" in Texas, Oklahoma, and California.

By 1910, significant oil fields had been discovered in Canada (specifically, in the province of Alberta), the Dutch East Indies (1885, in Sumatra), Persia (1908, in Masjed Soleiman), Peru, Venezuela, and Mexico, and were being developed at an industrial level.

Even until the mid-(1950s), coal was still the world's foremost fuel, but oil quickly took over. Following the 1973 energy crisis and the 1979 energy crisis, there was significant media coverage of oil supply levels. This brought to light the concern that oil is a limited resource that will eventually run out, at least as an economically viable energy source. At the time, the most common and popular predictions were always quite dire, and when they did not come true, many dismissed all such discussion. The future of petroleum as a fuel remains somewhat controversial. USA Today news (2004) reports that there are 40 years of petroleum left in the ground. Some would argue that because the total amount of petroleum is finite, the dire predictions of the 1970s have merely been postponed. Others argue that technology will continue to allow for the production of cheap hydrocarbons and that the earth has vast sources of unconventional petroleum reserves in the form of tar sands, bitumen fields and oil shale that will allow for petroleum use to continue in the future, with both the Canadian tar sands and United States shale oil deposits representing potential reserves matching existing liquid petroleum deposits worldwide.

Today, about 90% of vehicular fuel needs are met by oil. Petroleum also makes up 40% of total energy consumption in the United States, but is responsible for only 2% of electricity generation. Petroleum's worth as a portable, dense energy source powering the vast majority of vehicles and as the base of many industrial chemicals makes it one of the world's most important commodities. Access to it was a major factor in several military conflicts, including World War II and the Persian Gulf War. About 80% of the world's readily accessible reserves are located in the Middle East, with 62.5% coming from the Arab 5: Saudi Arabia (12.5%), UAE, Iraq, Qatar and Kuwait. The USA has less than 3%.

Environmental effects

The presence of oil has significant social and environmental impacts, from accidents and routine activities such as seismic exploration, drilling, and generation of polluting wastes. Oil extraction is costly and sometimes environmentally damaging, although Dr. John Hunt from Woods Hole pointed out in a 1981 paper that over 70% of the reserves in the world are associated with visible macroseepages, and many oil fields are found due to natural leaks. Offshore exploration and extraction of oil disturbs the surrounding marine environment. Extraction may involve dredging, which stirs up the seabed, killing the sea plants that marine creatures need to survive. Crude oil and refined fuel spills from tanker ship accidents have damaged fragile ecosystems in Alaska, the Galapagos Islands, Spain, and many other places.

Burning oil releases carbon dioxide into the atmosphere, which contributes to global warming. Per energy unit, oil produces less CO2 than coal, but more than natural gas. However, oil's unique role as a transportation fuel makes reducing its CO2 emissions a particularly thorny problem; amelioration strategies such as carbon sequestering are generally geared for large power plants, not individual vehicles.

Renewable energy source alternatives do exist, although the degree to which they can replace petroleum and the possible environmental damage they may cause are uncertain and controversial. Sun, wind, geothermal, and other renewable electricity sources cannot directly replace high energy density liquid petroleum for transportation use; instead automobiles and other equipment must be altered to allow using electricity (in batteries) or hydrogen (via fuel cells or internal combustion) which can be produced from renewable sources. Other options include using biomass-origin liquid fuels (ethanol, biodiesel). Any combination of solutions to replace petroleum as a liquid transportation fuel will be a very large undertaking.

Oil exports world demand

Future of oil

The Hubbert peak theory, also known as peak oil, is a theory concerning the long-term rate of production of conventional oil and other fossil fuels. It assumes that oil reserves are not replenishable (i.e. that abiogenic replenishment, if it exists at all, is negligible), and predicts that future world oil production must inevitably reach a peak and then decline as these reserves are exhausted. Controversy surrounds the theory, as predictions for when the global peak will actually take place are highly dependent on the past production and discovery data used in the calculation.

Proponents of peak oil theory also refer as an example of their theory, that when any given oil well produces oil in similar volumes to the amount of water used to obtain the oil, it tends to produce less oil afterwards, leading to the relatively quick exhaustion and/or commercial unviablility of the well in question.

The issue can be considered from the point of view of individual regions or of the world as a whole. Originally M. King Hubbert noticed that the discoveries in the United States had peaked in the early 1930s, and concluded that production would then peak in the early 1970s. His prediction turned out to be correct, and after the US peaked in 1971 - and thus lost its excess production capacity - OPEC was finally able to manipulate oil prices, which led to the oil crisis in 1973. Since then, most other countries have also peaked: Scotland's North Sea, for example in the late 1990s. China has confirmed that two of its largest producing regions are in decline, and Mexico's national oil company, Pemex, has announced that Cantarell Field, one of the world's largest offshore fields, is expected to peak in 2006, and then decline 14% per annum.

For various reasons (perhaps most importantly the lack of transparency in accounting of global oil reserves), it is difficult to predict the oil peak in any given region. Based on available production data, proponents have previously (and incorrectly) predicted the peak for the world to be in years 1989, 1995, or 1995-2000. However these predictions date from before the recession of the early 1980s, and the consequent reduction in global consumption, the effect of which was to delay the date of any peak by several years. A new prediction by Goldman Sachs picks 2007 for oil and some time later for natural gas. Just as the 1971 U.S. peak in oil production was only clearly recognized after the fact, a peak in world production will be difficult to discern until production clearly drops off.

One signal is that 2005 saw a dramatic fall in announced new oil projects coming to production from 2008 onwards. Since it takes on average four to six years for a new project to start producing oil, in order to avoid the peak, these new projects would have to not only make up for the depletion of current fields, but increase total production annually to meet increasing demand. 2005 also saw substantial increases in oil prices due to temporary circumstances, which then failed to be controlled by increasing production. The inability to increase production in the short term, indicating a general lack of spare capacity, and the corresponding uncontrolled price fluctuations, can be interpreted as a sign that peak oil has occurred or is presently in the process of occurring.

CLASSIFICATION

The oil industry classifies "crude" by the location of its origin (e.g., "West Texas Intermediate, WTI" or "Brent") and often by its relative weight (API gravity) or viscosity ("light", "intermediate" or "heavy"); refiners may also refer to it as "sweet", which means it contains relatively little sulfur, or as "sour", which means it contains substantial amounts of sulfur and requires more refining in order to meet current product specifications.

The world reference barrels are:

OPEC attempts to keep the price of the Opec Basket between upper and lower limits, by increasing and decreasing production. This makes the measure important for market analysts. The OPEC Basket, including a mix of light and heavy crudes, is heavier than both Brent and WTI.

See also [1]

In June 15, 2005 the OPEC basket was changed to reflect the characteristics of the oil produced by OPEC members. The new OPEC Reference Basket (ORB) is made up of the following: Saharan Blend (Algeria), Minas (Indonesia), Iran Heavy (Islamic Republic of Iran), Basra Light (Iraq), Kuwait Export (Kuwait), Es Sider (Libya), Bonny Light (Nigeria), Qatar Marine (Qatar), Arab Light (Saudi Arabia), Murban (UAE) and BCF 17 (Venezuela).

See also: http://www.opec.org/home/basket.aspx

Oil import demand by country

Pricing

References to the oil prices are usually either references to the spot price of either WTI/Light Crude as traded on New York Mercantile Exchange (NYMEX) for delivery in Cushing, Oklahoma; or the price of Brent as traded on the International Commodities Exchange (ICE, which the International Petroleum Exchange has been incorporated into) for delivery at Sullom Voe. The price of a barrel of oil is highly dependent on both its grade (which is determined by factors such as its specific gravity or API and its sulphur content) and location. The vast majority of oil will not be traded on an exchange but on a over-the-counter basis, typically with reference to a marker crude oil grade that is typically quoted via pricing agencies such as Argus Media Ltd and Platts. For example in Europe a particular grade of oil, say Fulmar, might be sold at a price of "Brent plus US$0.25/barrel" or as an intra-company transaction. IPE claim that 65% of traded oil is priced off their Brent benchmarks. Other important benchmarks include Dubai, Tapis, and the OPEC basket. The Energy Information Administration (EIA) uses the Imported Refiner Acquisition Cost, the weighted average cost of all oil imported into the US as their "world oil price".

It is often claimed that OPEC sets the oil price and the true cost of a barrel of oil is around $2, which is equivalent to the cost of extraction of a barrel in the Middle East. These estimates of costs ignore the cost of finding and developing oil reserves. Furthermore the important cost as far as price is concerned, is not the price of the cheapest barrel but the cost of producing the marginal barrel. By limiting production OPEC has caused more expensive areas of production such as the North Sea to be developed before the Middle East has been exhausted. OPEC's power is also often overstated. Investing in spare capacity is expensive and the low oil price environment in the late 90s led to cutbacks in investment. This has meant during the oil price rally seen between 2003-2005, OPEC's spare capacity has not been sufficient to stabilise prices.

Oil demand is highly dependent on global macroeconomic conditions, so this is also an important determinant of price. Some economists claim that high oil prices have a large negative impact on the global growth. This means that the relationship between the oil price and global growth is not particularly stable although a high oil price is often thought of as being a late cycle phenomenon.

A recent low point was reached in January 1999, after increased oil production from Iraq coincided with the Asian financial crisis, which reduced demand. The prices then rapidly increased, more than doubling by September 2000, then fell until the end of 2001 before steadily increasing, reaching US $40 to US $50 per barrel by September 2004. [2] In October 2004, light crude futures contracts on the NYMEX for November delivery exceeded US $53 per barrel and for December delivery exceeded US $55 per barrel. Crude oil prices surged to a record high above $60 a barrel in June 2005, sustaining a rally built on strong demand for gasoline and diesel and on concerns about refiners' ability to keep up. This trend continued into early August 2005, as NYMEX crude oil futures contracts surged past the $65 mark as consumers kept up the demand for gasoline despite its high price.

The New York Mercantile Exchange (NYMEX) trades crude oil (including futures contracts) and provides the basis of US crude oil pricing via WTI (West Texas Intermediate). Other exchanges also trade crude oil futures, eg the International Commodities Exchange (ICE) in London trades contracts in Brent crude. Even individuals can now trade crude oil through online trading sites margin account or their banks through structured products indexed on the Commodities markets.

See also History and Analysis of Crude Oil Prices

A World without oil

Top petroleum-producing countries

Source: Energy Statistics from the U.S. Government

In order of amount produced in 2004 (MMbbl/d = millions of barrels per day):

1 peak production already passed in this state 2 Though still a member, Iraq has not been included in production figures since 1998

In order of amount exported in 2003:

Note that the USA consumes almost all of its own production, whilst the UK has recently become a net-importer rather than net-exporter.

Total world production/consumption (as of 2005) is approximately 84 million barrels per day.

Commissioning and decommissioning a rig is a major issue

PETROLEUM and the MILITARY

BOOKS ABOUT PETROLEUM

Extinction - The Last Days on Earth

FILMS ABOUT OIL

LINKS

ARTICLES

DATA

HOW

MUCH OIL DOES YOUR FAMILY USE?

A taste for adventure

A heartwarming adventure: pirate whalers V conservationists

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

This website is Copyright © 1999 & 2024. Max Energy Limited is an educational charity working for world peace.

|