|

Paternoster

Square, London, England

WHAT

THE PAPERS SAY

Naturally,

the media report on the state of the nation, including share and stock

trading, for that kind of movement is an economic indicator that the

people have a right to know about. This is called freedom of the press

and transparency is what it is all about. People in charge of so much

money must be held accountable. This is one reason we follow the media

reports on the London Stock Exchange and publish information that may

affect you or your own company, or the health of the planet as a whole.

LONDON STOCK EXCHANGE GROUP PLC OWN SHARE PURCHASE 15 MAY 2017

London Stock Exchange Group plc (the "Company") announces that it has purchased through Barclays Capital Securities Limited, in accordance with the authority granted by shareholders at the Company's Annual General Meeting on 26 April 2017, the following number of its ordinary shares of 6 79/86 pence each ("Shares") on the London Stock Exchange as part of the buyback programme announced on 29 March 2017:

Date of purchase: 15 May 2017

Number of Shares purchased: 30,000 Shares

Highest price paid per Share: 3470.0000 pence

Lowest price paid per Share: 3465.0000 pence

Average price paid per Share: 3469.5330 pence

The Company intends to hold the purchased Shares in treasury.

The total number of Shares held in treasury by the Company following the above purchases is 1,505,239. The Company has 348,937,543 Shares in issue excluding such treasury shares.

In accordance with Article 5(1)(b) of Regulation (EU) No 596/2014 (the Market Abuse Regulation), the schedule below contains detailed information about the individual purchases made by Barclays Capital Securities Limited on behalf of the Company as part of the buyback programme.

CITY A.M. - SUNDAY 14 MAY 2017

How the London Stock Exchange has retained its international allure after Brexit vote and Deutsche Boerse deal collapse.

The past 11 months have been a tumultuous period for many British businesses. But the London Stock Exchange Group has probably had a rockier ride than most.

In addition to the uncertainty around Brexit that all firms have had to deal with, the LSE has also endured UK businesses being frightened off stock exchange flotations, the breakdown of its mega-merger with Deutsche Boerse and the politicisation of one of the largest part of its business, with European Union politicians seemingly intent on dismantling London’s dominance over the euro clearing market.

Despite its troubles, the LSE has had a few things to shout about in recent months. And, perhaps surprisingly after last year’s Brexit vote, they have centred around international businesses showing an interest in London and the stock exchange. This is set to continue.

The LSE’s most high-profile win this year has probably come from billionaire US hedge fund manager Bill Ackman, who listed Pershing Square Holdings in London earlier this month.

Bank of Cyprus also listed on the LSE earlier this year, while Ireland’s government is planning to float Allied Irish Banks (AIB) in London, as well as Dublin, in the coming months.

Elsewhere, Kuwait Energy has this month announced plans for a London float, while Dubai’s ADES International, an oil services company, entered the market last Friday, and the National Highways Authority of

India became the latest Indian company to list masala bonds on the LSE last week.

“We’ve always been a very global market,” says Nikhil Rathi, chief executive of the London Stock Exchange Plc, the LSE group’s UK business, who is in charge of international development for the company as a whole.

“The reason people come to London is the rule of law, regulatory integrity, timezone, depth of investor base, liquidity, fairness of the legal system... Nothing that’s happened in the last year has changed that, or will change this fundamentally. This is a tradition in London that goes back hundreds of years.”

These are no doubt some of the arguments the LSE and its executives are using in a bid to lure Saudi Aramco to list part of its business in London next year. The LSE is thought to be in competition with New York,

Tokyo, Toronto, Singapore and

Hong Kong for what is expected to be the biggest float in history.

“You’re not going to draw me on that one, I’m afraid,” says Rathi, asked about progress on Saudi Aramco. “That’s going to be a no comment.”

The LSE has not publicly acknowledged it is chasing Aramco. But it became hard to deny when group chief executive Xavier Rolet joined Prime Minister Theresa May on a trip to

Saudi Arabia in early April.

Rathi, who joined the LSE from the Treasury, acknowledges that the company and the government “work very closely together” to lure investment into London.

“I think that listings on the London Stock Exchange are a very powerful symbol of the global nature of the UK’s trading relationships and ambitions,” he says. “Companies often first interact with the UK, in its broadest sense, through our capital markets.”

In the run-up to last year’s EU referendum, Rathi’s boss, Rolet, told City A.M. that Brexit would be “far worse than not good” for the City of London. “It’s my humble opinion, based on my experience of what I do every day, that the impact on the

City of London would be substantial, and almost immediate,” he said at the time.

Although there has been a lot of noise around financial services firms moving jobs into the EU, it would be a stretch now to claim that there was a substantial impact yet. And Rathi and the LSE do not appear too concerned at present.

“The fundamental strength that we have hasn’t changed,” he says. “There are clearly a set of discussions going on that we will all monitor. But, from our perspective as the exchange, we are a very global organisation and have global orientation, and I think that stands us in very good stead for whatever might happen.”

Read more: London Stock Exchange boss joins PM in Saudi Arabia as he seeks Aramco IPO

A big part of the LSE’s future plans, until recently, was its merger with Deutsche Boerse. The companies said last June that the vote outcome did not “impact the compelling strategic rationale of the merger”. However, the vote is widely thought to have played a role in the breakdown of the deal.

How much of a blow was the deal breakdown to the LSE, and to Rathi as the man in charge of international development?

“I don’t think that our strategy is fundamentally changed,” he says. “We have got businesses that are performing pretty well right across the board: our capital markets businesses, our information services businesses, our clearing businesses all doing pretty well, across the London Stock Exchange Group. That is reflected in our most recent results. Investors are responding well, if you look at our share price.

“So, yes, this could have been a significant transaction. It hasn’t happened, we’ve moved on.”

PLASTI C

INVESTMENT

ocean waste pollution solution. The

autonomous ship

above called SeaVax,

could be the answer

that the many organizations seeking to draw attention to the problem - are

looking for.

The company looking to develop this technology is based near Eastbourne

in Sussex (see picture below of Eastbourne Pier). They are not looking

for venture capital or stock market floatation. Why? Because they are a

not for profit concern, partly crowd funded and looking for social

support as an academic enterprise. Crowd funding is an alternative way

of kick starting a project where conventional bank and venture capital

loans would not be forthcoming. For example, the Cleaner Oceans

Foundation is a charitable concern without share capital, hence could

not issue shares to investors seeking a dividend.

THE GUARDIAN MARCH 2017

EC blocks London Stock Exchange's £22bn merger; pound slips back- as it happened.

European markets move higher on Brexit trigger day

Shrugging off the worries about the outcome of the Brexit talks which can now get underway, most European markets managed end the day positively. Germany’s Dax hit a new two year high and came within 200 points of its all time high of 12,392 reached in April 2015. The FTSE 100 was helped by the weakness in the pound following the triggering of Article 50, and even an early fall on Wall Street failed to pull European shares lower. The final scores showed:

The FTSE 100 finished up 0.41% or 30.30 points at 7373.72

Germany’s Dax rose 0.44% to 12,203.00

France’s Cac climbed 0.45% to 5069.04

But Italy’s FTSE MIB fell 0.26% to 20,276.8

Spain’s Ibex ended 0.21% lower at 10,367.6

In Greece, the Athens market added 0.61% to 668.55

On Wall Street, the Dow Jones Industrial Average is currently down 58 points or 0.28%

way from Brexit and the UK, and the Dow Jones Industrial Average is on the slide in early trading.

On Tuesday, the Dow avoided closing lower for the ninth day in a row, which would have been its worst performance for almost 40 years. But the respite has been brief, and it is now down 53 points or 0.26%. The S&P 500 and Nasdaq Composite both edged lower at the open.

Oil prices are on the rise as the US reported that crude stocks rose by less than expected last week.

US oil inventories climbed by 0.9m barrels to 534m barrels according to the Energy Information Administration. This compares to the 5m gain recorded in the previous week, and the 2m forecast by analysts.

The news of stronger than expected demand has helped push Brent crude up 1.6% to $52.17 a barrel and West Texas Intermediate a similar amount to $49.18.

BBC NEWS MARCH 2017

London Stock Exchange-Deutsche Boerse deal blocked by EU

EU regulators have blocked London Stock Exchange's £21bn merger with German stock exchange Deutsche Boerse.

The European Commission said the deal would have created a "de facto monopoly" for certain financial services.

The merger would have combined Europe's two largest stock exchange operators.

London Stock Exchange Group said it "regrets" the commission's decision, as the deal would have created a "world-leading" financial markets firm.

The commission blocked the deal, which had already been thrown into doubt by Brexit, shortly before the UK started the formal process of leaving the European Union.

It is the third time that a merger between LSE and its German rival has failed to come to fruition.

They announced plans for a "merger of equals" about a year ago, following attempts by Deutsche Boerse to strike a deal with LSE in 2000 and 2004.

'Coup de grace'

However, the merger was dogged by questions about where the joint firm would be based and how it would pool liquidity between the exchanges.

Those questions intensified after the UK voted to leave the European

Union.

"Timing is everything," said Neil Wilson, an analyst at ETX Capital.

"Brexit effectively killed this deal off nine months ago, so it's fitting that EU competition commissioner Margrethe Vestager delivered the coup de grace just a couple of hours before the UK triggers Article 50."

LSE warned last month that the deal was unlikely to receive EU approval over concerns that it would limit competition.

On Wednesday, the firm said: "This was an opportunity to create a world leading market infrastructure group anchored in Europe, which would have supported Europe's 23 million SMEs [small and medium sized enterprises]."

The UK's stock exchange operator has been a takeover target many times since 2000. Mr Wilson says the collapse of the Deutsche Boerse merger might encourage new bidders, possibly from the US.

But he says new national interest rules about takeovers of UK firms could make any deal even more difficult.

DAILY MAIL 7 JAN 2016

London stock market sees £31bn wiped off its value as China turmoil sends global shares into New Year rout

The London stock market saw almost £31billion wiped off its value today as the New Year global rout sparked by trading turmoil in China and plunging oil prices goes on.

Blue-chip shares fell by 2 per cent but it could have been much worse as US stocks managed to avoid catastrophic falls on the Wall Street open this afternoon.

China's meddling in the Shanghai stock market has caused havoc across global markets this week. But after plummeting 3 per cent on the open, the FTSE 100 index recovered after lunch when the Dow Jones traded only 1 per cent down, signalling relative stability.

The London index still finished 119 points or 2 per cent down for the day at 5,954.08 but it had earlier plunged well below 5,900 on news overnight that trading in Shanghai had been stopped after share prices fell off a cliff again - the second intervention by Chinese authorities this week.

The tumble took the UK blue-chip index's losses for the week to 6.5 per cent and the Shanghai benchmark alone has dropped 12 per cent in the first week of 2016.

Markets in Asia are being hit by the withdrawal of Chinese government measures introduced last year to prop up share prices, while investors are also unnerved by signs of a worsening slowdown in China's economy.

Steep falls in oil prices are compounding the worldwide stock market sell-off, with the cost of benchmark Brent crude collapsing to fresh 11-year lows, sinking below 33 US dollars a barrel during the day.

The picture was dire across Europe, with the Dax in Germany shedding more than two per cent and France's Cac 40 off 1.7 per cent. In

New York the Dow Jones Industrial Average was down more than 150 points in early trading - but showed signs of resilience that encouraged London traders to cease mass selling of equities.

Traders said the new so-called 'circuit-breaker system' employed by Chinese authorities to halt precipitous falls in their own stock market was having adverse effects - namely that it was encouraging panic selling on the opening bell of the following day.

Gerry Alfonso, at Shenwan Hongyuan Group said: 'It is clearly adding some unintended consequences, such as people trying to sell before the break, which is actually accelerating the decline.'

The China Securities Regulatory Commission said in a statement on its website: 'The circuit breaker mechanism is not the main reason for the market drop, but based on the experience of the two recent instances, it hasn’t achieved the expected effect, but rather produced a definite ‘magnetic effect.'

Meanwhile analysts said that the circuit breaker was a classic example of the 'phony' capitalism that China has installed.

Jason Hollands, at Tilney Bestinvest, said: 'Wow, what a dramatic first week to the year, after steep declines on its stock exchanges, which have twice seen trading suspended under supposed 'circuit breaking' mechanisms aimed at stemming volatility, the Chinese Securities Regulation has capitulated in its fight with the market and suspended the mechanism.

'Such an abundant and rapid policy failure is a real blow in a system which prides itself on the perception of being in control and Chinese attempts to meddle in the markets which we've seen over the last year through first encouraging equity investment and then taking desperate and even draconian measures to halt selling provides a stark reminder, that China's version of capitalism is a phony one that looks increasingly fragile.'

'In a capitalist economy, the market is an information system, the corollary of millions of individual choices and continually self-adjusting, where the default and bankruptcy cycle provides a process of creative destruction and room for vibrant new entrants to emerge.

'In China, however, top down plans and political and bureaucratic direction continue to take precedence and this has resulted in a dangerously unbalanced model.'

Alastair McCaig at IG added: 'The latest twist in the plot has been Chinese regulators deciding to dispense with their new circuit breaker system. Having now been triggered into action twice in the first four days of the year, the inability to trade while markets are suspended looks to be creating even more panic than markets being left to their own devices.'

Connor Campbell, at Spreadex, continued: 'It seems that investors, for now at least, are taking the news as a positive, the move ostensibly preventing the panic-pause-more panic pattern that appeared in the Chinese markets on Monday and Thursday from repeating itself.'

He added: 'That's the theory, at least; we'll just have to see how it works in practice tomorrow morning, as whilst the exacerbating nature of the circuit breaker rule may have been removed, the fear-inspiring issues currently scaring the bejesus out of investors remain unsolved.'

But despite the end of the circuit breaker, there are still plenty of worries for investors.

North Korea conducted a nuclear test earlier this week, tension is growing between Saudi Arabia and Iran, and Britain has threatened to leave the European Union.

Throw in economic contractions from the likes of Brazil and Russia and divergent monetary policy by central banks around the world for the first time since the 1990's and it comes as no surprise that investors remain nervy.

Billionaire investor George Soros also played his part, telling an economic forum in

Sri Lanka, that there are similarities between the present environment and the financial crash of 2008.

Steep falls in oil prices were also compounding the worldwide stock market sell-off, with the cost of benchmark Brent crude collapsing below $33 a barrel, close to levels not seen since the 2008 financial crisis.

Andy McLevey, head of dealing at stockbroker Interactive Investor, said: 'With oil prices continuing to plummet and geopolitical tensions to the fore, investors are scurrying to the sidelines and even these current levels may not be enough to tempt many back short term as the uncertainty continues.'

And the latest stock market falls come as Chancellor George Osborne warned over a 'dangerous cocktail' of threats to the UK economy in a speech made in Cardiff.

He said: 'We are only seven days into the new year, and already we've had worrying news about stock market falls around the world, the slowdown in China, deep problems in Brazil and in Russia.

'Commodity prices have fallen very significantly. Oil, which was over $120 a barrel in 2012, now stands at less than $40.'

In London, miners again led the declines, with Anglo American the top blue chip faller, down 9 per cent, while BHP Billiton and Antofagasta both shed 5 per cent.

Blue chip oil companies were also among the hardest hit as the cost of crude continues to be hammered by global oversupply and falling demand amid the slowdown in the world economy and China.

BP, Royal Dutch Shell, and BG Group all fell around 5 per cent as well

Marks & Spencer was one of only two stocks in positive territory, however, adding 1 per cent as the retailer announced the retirement of chief executive Marc Bolland in April and named 25-year M&S veteran Steve Rowe as his replacement.

The news came as the high street bellwether revealed a dire performance from its clothing division, with like-for-like general merchandise sales down 5.8 per cent over the

Christmas quarter, although its food halls saw robust growth of 0.4 per cent.

M&S chairman Robert Swannell insisted there had been no shareholder pressure on Mr Bolland to quit, adding that his succession had been planned for years.

The other blue chip gainer was precious metals miner Randgold Resources, up 2 per cent as the price of

gold rose further towards $1,100 an ounce on safe haven buying.

On currency markets, safe-haven buying also gave a boost to the dollar, which rose to a five-and-a-half year high versus the pound at $1.4558.

The dollar's gains were helped too by the publication last night of minutes from last month's Federal Reserve policy meeting, which suggested that there could be four further hikes in US interest rates this year after December's first move since 2008.

Howard Archer, Chief UK and European Economist at IHS Global, said: 'The pound has weakened as expectations of a Bank of England interest rate hike any time soon have waned and there has also been a mounting market focus on the UK's referendum on EU membership.

'Expectations of an interest rate hike have been pushed back by recent mixed UK economic data, a relapse in earnings growth and the likelihood that inflation will stay lower for longer due to oil prices falling to new lows.

'The pound's weakening is very welcome news for UK exporters who have found sterling's strength as a major handicap in recent times, and it will boost hopes that economic growth can finally become a little less dependent on domestic demand

But, he added: 'Of course, the weaker pound is less good news for UK holidaymakers and businessmen going abroad, particularly to the US.'

BLUE PRISM 15 MARCH 2016

Software Robots Pioneer Blue Prism Debuts on the London Stock Exchange’s AIM Market

Leading Provider of Enterprise Robotic Process Automation (RPA) Drives Global Growth of the Digital Workforce London & Miami, March 15, 2016 – Blue Prism, the pioneering developer of enterprise

Robotic Process Automation (RPA) software, today announced its debut on AIM of the London.

THE

LONDON

STOCK EXCHANGE

The

London

Stock Exchange is a stock exchange located in the City of London in

the United

Kingdom. As of December 2011, the Exchange had a market

capitalisation of US$3.266 trillion (short scale), making it the

fourth-largest stock exchange in the world by this measurement (and the

largest in Europe). The Exchange was founded in 1801 and its current

premises are situated in Paternoster Square close to St Paul's Cathedral

in the City of London.

The Exchange is part of the London Stock Exchange Group.

Normal

trading sessions on the main orderbook (SETS) are from 08:00 to 16:30

every day of the week except Saturdays, Sundays and holidays declared by

the exchange in advance. The detailed schedule is as follows:

Trade reporting 07:15–07:50

Opening auction 07:50–08:00

Continuous trading 08:00–16:30

Closing auction 16:30–16:35

Order maintenance 16:35–17:00

Trade reporting only 17:00–17:15

Sustainable

energy policies that have force are needed to maintain stable markets.

Politicians pandering to the public cry for cleaner air, are only paying

lip service to such demands. When in reality, clear direction is needed

if they expect industry to part with high profits from dirty coal.

LSE

TAKEOVERS

Nearly

50 per cent of the London Stock Exchange is now in the hands of

two rival Gulf states battling to be their region’s leader in global

exchange consolidation.

Qatar

Investment Authority and Borse Dubai now own 48 per cent of the LSE

following a complex series of deals in which ownership of Europe’s

exchanges is being realigned.

Borse

Dubai secured 28 per cent of the LSE as part of a wider deal with the

US-based Nasdaq designed to settle their long-running battle

for control of the Nordic exchanges and telecommunications operator OMX.

The Dubai group bought most of Nasdaq’s 31 per cent stake in the LSE

for £14.40 a share in cash. In return, it will take a 19.9 per cent

stake on the combined Nasdaq/OMX group and receive cash.

However,

the move enraged the Qatar Investment Authority, which until Tuesday

night believed it was close to clinching a deal to buy much of the LSE

stake for itself.

It

responded on Thursday by buying nearly 20 per cent of the LSE for

itself, sparking expectations of a bidding war for the exchange. LSE

on Thursday welcomed the Qatari move because it sees QIA as a passive

investor.

Katherine

Hudson - Entrepreneur & investor in her own tent/event companies.

Meanwhile,

the QIA also bought nearly 10 per cent of OMX, a move widely

interpreted as a sign it, too, will make a competing offer for the

Stockholm-based group. It also issued a statement calling on OMX

shareholders to do nothing in response to the offer from Borse Dubai.

LSE

shares soared on Thursday, closing £2.34 higher at £16.87.

Qatar

bought the stakes held by two hedge funds instrumental in seeing off a

hostile bid for the LSE by Nasdaq last year, believing that the £12.43

price it offered was too low.

However,

before official word of the deal was published, there were signs that

it might face political opposition in the US. Senator Charles Schumer,

chairman of the Joint Economic Committee, said: “This deal raises

serious questions . . . Those questions will include – should we

allow foreign governments to take over our financial exchanges and how

much control and influence should those foreign governments have?”

President

George W. Bush on Thursday said the proposed investment by

state-controlled Borse Dubai in the US exchange would face a national

security review.

THE

LSE'S MANY SUITORS

2000 - Deutsche Boerse and LSE announce talks, but no deal agreed

2000 - Sweden's OMX makes an £800m bid for LSE, but it is turned down

2004 - Deutsche Boerse returns with another bid for LSE, which is

rejected

2005 - Australia's Macquarie Bank makes a £1.6bn takeover bid, also turned down

2006 - US exchange Nasdaq takes almost a 30% stake in LSE, but sees its £2.7bn offer rejected

2011 - LSE agrees merger with the Canadian stock exchange, TMX, but it falls through

2017 - LSE and Deutsche Boerse merger - which would value the combined firm at £21bn - blocked by EU

The final blow to the deal came from EU regulators' concerns about the combined firm's control over the clearing of bonds and fixed-income products in

Europe.

LSE, which also operates the Italian stock exchange and has other businesses in Europe, had offered to sell its France-based clearing house to deal with those concerns.

'Disproportionate'

However, the commission decided that this remedy did not go far enough.

Margrethe Vestager, the EU commissioner in charge of competition policy, said: "The European economy depends on well-functioning financial markets.

"That is not just important for banks and other financial institutions. The whole economy benefits when businesses can raise money on competitive

financial markets."

The commission had ordered LSE to also sell its 60% stake in MTS, a fixed-income trading platform, but LSE said the move was "disproportionate".

Investors responded positively to the deal's collapse, with shares in LSE rising by more than 3% and in Deutsche Boerse by nearly 2%.

WIKIPEDIA

ON THE LONDON STOCK EXCHANGE

LSE GROUP HISTORY

The London Stock Exchange was founded in Sweeting's Alley in London in 1801. It moved to Capel Court the following year.

In 1972 the Exchange moved to a new purpose-built building and trading floor in Threadneedle Street. Deregulation, sometimes known as "big bang", came in 1986 and external ownership of member firms was allowed for the first time. In 1995 the Alternative Investment Market was launched and in 2004 the Exchange moved again, this time to Paternoster Square.

Nasdaq built up a stake of over 30% in the Exchange in 2007 in a failed attempt to acquire it. It has since sold its investment.

In 2007 the Exchange acquired the Milan-based Borsa Italiana for 1.6bn euro (£1.1bn; $2bn) to form the London Stock Exchange Group plc. The combination was intended to diversify the LSE's product offering and customer base. The all-share deal diluted the stakes of existing LSE shareholders, with Borsa Italiana shareholders receiving new shares representing 28 per cent of the enlarged register.

On 16 September 2009, the London Stock Exchange Group agreed to acquire Millennium Information Technologies, Ltd., a Sri Lankan-based software company specialising in trading systems, for US$30m (£18m). The acquisition was completed on 19 October 2009.

On 9 February 2011 TMX Group, operator of the Toronto Stock Exchange agreed to join forces with the London Stock Exchange Group in a deal described by TMX head Tom Kloet as a 'merger of equals' (though 8/15 board members of the combined entity will be appointed by LSE, 7/15 by TMX). The deal, subject to government approval would create the world's largest exchange operator for mining stocks. In the UK the LSE Group first announced it as a takeover, however in Canada the deal was reported as a merger. The provisional name for the combined group would be LTMX Group plc. On 13 June 2011, a rival, and hostile bid from the Maple Group of Canadian interests, was unveiled for the TMX Group. This was a cash and stock bid of $3.7 billion CAD, launched in the hope of blocking the LSE Group's takeover of TMX. The group was composed of the leading banks and financial institutions of Canada. The London Stock Exchange however announced it was terminating the merger with TMX on 29 June 2011 citing that "LSEG and TMX Group believe that the merger is highly unlikely to achieve the required two-thirds majority approval at the TMX Group shareholder meeting".

In July 2012, the LSE bought a 5% stake in Delhi Stock Exchange.

On 2 June 2014, the LSE became the 10th stock exchange to join the United Nation's Sustainable Stock Exchanges (SSE) initiative.

On 26 June 2014, the LSE announced it had agreed to buy Frank Russell Co., making it one of the largest providers of index services.

In January 2015, Reuters reported that the London Stock Exchange Group planned to put Russell Investments up for sale, and estimates the sale will produce $1.4 billion per unit.

In March 2016, the company announced it had reached an agreement with Deutsche Börse to merge. The companies will be brought under a new holding company, UK TopCo, and will retain both headquarters in London and Frankfurt. On 25 February 2017, the London Stock Exchange Group PLC stated it wouldn't sell its fixed-income trading platform in Italy to Deutsche Börse AG, to appease anti-trust concerns. The planned merger between the two exchanges, which was estimated to create the largest exchange in Europe, was subsequently described as "at risk" by the Wall Street Journal.

LSE OPERATIONS

Following the merger with Borsa Italiana, the group is Europe's leading equities business, with 48% of the FTSEurofirst 100 by market capitalisation and with the most liquid order book by value and volume traded. Its activities include:

* London Stock Exchange: The London Stock Exchange is Europe's leading stock exchange and is owned by the London Stock Exchange Group plc.

* Borsa Italiana: Borsa Italiana is Italy's leading stock exchange and is owned by the London Stock Exchange Group plc.

* MillenniumIT: MillenniumIT was acquired by LSEG in 2009 as their technology service provider. It offers a trading platform known as Millennium Exchange and is available for use at most of the leading stock markets in the world.

* Cassa di Compensazione e Garanzia ('CC&G'): CC&G provides central counterparty services. It was purchased along with Borsa Italiana in 2007.

* Monte Titoli: Monte Titoli is the Italian Central Securities Depository for Italian issued financial instruments. It performs pre-settlement, settlement and custody services for its member participants. It was created in 1978 and acquired by the Borsa Italiana in 2002 before becoming part of the LSEG.

* Tokyo Stock Exchange joint venture: in July 2008 the LSE and the Tokyo Stock Exchange (TSE) announced a new joint venture Tokyo-based market, which will be based on the LSE's Alternative Investment Market (AIM).

* Turquoise: on 21 December 2009, the LSE agreed to take a 60% stake in rival trading platform Turquoise, which currently has a 7% share of the market. Turquoise will be merged with the LSE's trading facility Baikal Global.

* LCH.Clearnet: on 3 April 2012, LSE and LCH.Clearnet shareholders voted overwhelmingly to take up to 60 percent of the clearing operator with an offer of 20 euros per share, which valued LCH.Clearnet at 813 million euros ($1.1 billion).

* FTSE Russell: through its acquisition of the Frank Russell Company in 2015, London Stock Exchange Group combined FTSE Group with Russell Indexes to form FTSE Russell, now one of the largest index providers in the world.

* Exactpro: on 29 May 2015 LSEG acquired a 100% interest in Exactpro. It offers quality assurance services to exchanges, investment banks, brokers and other financial sector organisations.

ABOUT THE LONDON STOCK EXCHANGE

ACTIVITIES

Primary markets

Issuer services help companies from around the world to join the London equity market in order to gain access to capital. The LSE allows companies to raise money, increase their profile and obtain a market valuation through a variety of routes, thus following the firms throughout the whole IPO process.

The London Stock Exchange runs several markets for listing, giving an opportunity for different sized companies to list. International companies can list a number of products in London including shares, depositary receipts and debt, offering different and cost-effective ways to raise capital. In 2004 the Exchange opened a Hong Kong office and has attracted more than 200 companies from the Asia-Pacific region.

For the biggest companies exists the Premium Listed Main Market. This operates a Super Equivalence method where conditions of both the UK Listing Authority as well as London Stock Exchange’s own criteria have to be met. The largest IPO on the Exchange was completed in May 2011 by Glencore International plc. The company raised $10 billion at admission, making it one of the largest IPOs ever since foundation.

In terms of smaller SME’s the Stock Exchange operates the Alternative Investment Market (AIM). For international companies that fall outside of the EU, it operates the Depository Receipt (DR) scheme as a way of listing and raising capital.

There are also two specialised markets:

Professional Securities Market This market facilitates the raising of capital through the issue of specialist debt securities or depositary receipts (DRs) to professional investors. The market operates under the status as a Recognised Investment Exchange, and by July 2011 it had 32 DRs, 108 Eurobonds and over 350 Medium Term Notes.

Specialist Fund Market Is the London Stock Exchange dedicated market, designed to accept more sophisticated fund vehicles, governance models and security. It is suitable only for institutional, professional and highly knowledgeable investors. The Specialist Fund Market is an EU Regulated Market and thus securities admitted to the market are eligible for most investor mandates providing a pool of liquidity for issuers admitted to the market

Secondary markets

The securities available for trading on the London Stock Exchange:

Bonds, including retail bonds

Common stock

Covered warrants

Exchange-traded funds

Exchange-traded products

Global depositary receipts (GDRs)

Structured products

There are two main markets on which companies trade on the LSE: 1. Main Market The main market is home to Over 1,300 large companies from 60 different countries. Over the past 10 years over £366 billion has been raised through new and further issues by Main Market companies. The FTSE 100 Index ("footsie") is the main share index of the 100 most highly capitalised UK companies listed on the Main Market. 2. Alternative Investment Market ("AIM") The Alternative Investment Market is LSE’s international market for smaller growing companies. A wide range of businesses including early stage, venture capital backed as well as more established companies join AIM seeking access to growth capital. The AIM falls within the classification of a Multilateral Trading Facility (MTF) as defined under the MiFID directive in 2004, and such is a flexible market with a simpler admission process for companies wanting to be publicly listed.

There are also several electronic platforms on which the different products trade.

SETS (Stock Exchange electronic Trading Service)

SETS is the London Stock Exchange’s flagship electronic order book, trading indexed securities (FTSE100, FTSE250, FTSE Small Cap Index constituents, Exchange Traded Funds, Exchange Trading Products as well as other liquid AIM, Irish, and London Standard listed securities)

SETSqx (Stock Exchange electronic Trading Services – quotes and crosses)

SETSqx is a trading platform for securities less liquid than those traded on SETS. This platform combines a periodic electronic auction book four times a day with standalone non-electronic quote driven market making.

SEAQ

SEAQ is the London Stock Exchange’s non-electronically executable quotation service that allows market makers to quote prices in AIM securities and the Fixed Interest market.

International Trading Service

IOB: The International Order Book offers easy and cost efficient access for traders looking to invest in fast growing economies; for example, in Central and Eastern Europe, Asia and the Middle East via depositary receipts (DRs). It is based on an electronic order book similar to SETS.

European Quoting Service: the European Quoting Service is a service that enables clients to meet their pre-trade pan-European transparency obligations.

A pan-European trade reporting service that enables clients to meet their post-trade reporting obligations whether trading on or off Exchange.

Derivatives

Trading of derivatives products is available on the Turquoise platform (ex EDX London). Products are Norwegian Futures and options on Norwegian single stocks and indices, Russian futures and options on the most liquid IOB Depositary Receipts, Futures, options on the FTSE RIOB index and futures on the FTSE 100. Futures and options on the most liquid European stock underlyings and on European benchmark indices were expected to be launched in Q4 2011 and Q1 2012 subject to Financial Services Authority approval.

Fixed Income

MTS

MTS is a fixed income trading electronic platform, trading European government bonds, quasi-government bonds, corporate bonds, covered bonds and repo. MTS provides access to both cash and repo markets as well as fixed income market data and fixed income indices. It is majority owned by the London Stock Exchange Group. Shareholding firms also include large international banks such as J.P. Morgan, Deutsche Bank and BNP Paribas.

The largest products offered are:

MTS BondVision (Dealer-to-client electronic market)

MTS Cash

MTS Credit (for euro-denominated, non-government bonds)

MTS Data

MTS Indices

MTS Repo

Order book for Retail Bonds Launched in February 2010, the Order book for Retail Bonds (ORB) offers continuous two-way pricing for trading in UK gilts and retail-size corporate bonds on-exchange. ORB acts as an electronic secondary market for retail investors. 2009 saw highest ever inflow into bond funds, net total of £10.7bn, this inflow driven almost entirely by retail investors (90% of total), with corporate bonds being the bestselling sector.

ORB offers an open and transparent market model for trading in retail-size. Currently[when?] there are five dedicated market makers committed to quoting two-way prices in a range of retail bonds throughout the trading day. New market models means private investors will be able to see prices on-screen and trade in bonds in a similar way as they currently do for shares. This creates a greater efficiency of electronic on-book execution and option to use straight-through-processing to settlement system.

Retail Bonds are driven by cost-effectiveness, simplicity of transaction charging and standardisation of market structure. The key aim of ORB is to increase distribution for bonds by opening up these markets to private investors who may have previously felt excluded from this market. This is by increasing the availability of publication on offer, detailing the risks and benefits involved in Retail Bonds, such as taxation.

New entrants into ORB have been able to raise sufficient funds, such as Places for People who were able to raise capital of £140 million. This portrays the advantage using ORB can have, even for non-bank smaller firms seeking to raise capital.

STATISTICS

There are currently 2,938 companies from over 60 countries listed on the London Stock Exchange, of which 1151 are on AIM, 44 on the Professional Securities Market and 10 on the Specialist Funds Market. Pence sterling (GBX) is a subdivision of Pounds sterling (GBP). Pounds are official currency of the United Kingdom, but pence are often used when trading stocks. e.g. a stock traded at GBX 2,360 is valued at £23.60.

As of June 2011, the AIM had 56 companies as per country of operations from Africa, 41 from China, 26 from Latin America, 23 from Central & Eastern Europe and 29 from India & Bangladesh, making it one of the world’s leading growth markets. Since its launch in 1995, more than £67 billion have been raised on AIM. The total market value of these companies was £3.9 trillion. The daily turnover traded in July 2011 was £4.4 billion (€5.0 billion) and the daily number of trades 611,941. The LSE’s share of trading in the UK lit order book trading was 62.2%. As of 2011 the London Stock Exchange offered trading in more emerging markets exchange traded funds (ETFs) than any other exchange in the world. There were a total of 158 emerging market ETFs listed on the Exchange in May 2011 compared with 126 on the New York Stock Exchange (NYSE Arca) and 93 on Deutsche Boerse.

TECHNOLOGY

The LSE's current trading platform is its own Linux-based edition named Millennium Exchange.

Their old trading platform TradElect was based on Microsoft's .NET Framework, and was developed by Microsoft and Accenture. 00pMicrosoft used the LSE software as an example of the supposed superiority of Windows over Linux in the "Get the Facts" campaign, claiming that the LSE system provided "five nines" reliability, and a processing speed of 3–4 milliseconds. For Microsoft, LSE was a good combination of a highly visible exchange and yet a relatively modest IT problem.

Despite TradElect only being in use for about two years, after suffering multiple periods of extended downtime and unreliability the LSE announced in 2009 that it was planning to switch to Linux in 2010. LSE main market migration to MillenniumIT technology was successfully completed in February 2011.

LSEG now provides high performance technology solutions, including trading, market surveillance and post trade systems for over 40 organisations and exchanges, including the Group’s own markets. Additional services include network connectivity, hosting and quality assurance testing. MillenniumIT, GATElab and Exactpro are among the Group’s technology companies.

MERGERS & ACQUISITIONS

Borsa Italiana

On 23 June 2007, the London Stock Exchange announced that it had agreed on the terms of a recommended offer to the shareholders of the Borsa Italiana S.p.A. The merger of the two companies created a leading diversified exchange group in Europe. The combined group was named the London Stock Exchange Group, but still remained two separate legal and regulatory entities. One of the long-term strategies of the joint company is to expand Borsa Italiana’s efficient clearing services to other European markets.

MTS

In 2007, after Borsa Italiana announced its call option exercise right to acquire full control of MBE Holdings, the combined Group would now control Mercato dei Titoli di Stato, or MTS. This merger of Borsa Italiana and MTS with LSE's existing bond-listing business, enhanced the range of covered European fixed income markets.

Turquoise

The London Stock Exchange acquired Turquoise (TQ), a Pan-European MTF, in 2009 and since coupling with MillenniumIT’s software, it currently offers the fastest latency bar none in Europe. Currently the speed of latency on Turquoise (as measured at the end of August 2011) is 97 micro seconds on average for 99.9% of trades. Initially founded by a consortium of nine banks, it is now majority owned by the London Stock Exchange Group. Currently shareholders include twelve of the leading Investment Banks.

Turquoise operates a maker-taker fee scheme, 0.30 basis points for aggressive traders and 0.20 rebates for passive traders, providing liquidity. The market share of Turquoise as an MTF has doubled over the past twelve months, from 3% to 6%. There are currently 2,000 securities, across 19 countries that are on Turquoise. Unlike Broker-Dealer Crossing Networks, TQ does not discriminate as to who can trade on their platform.

NASDAQ bids

In December 2005, the London Stock Exchange rejected a £1.6 billion takeover offer from Macquarie Bank. The London Stock Exchange described the offer as "derisory", a sentiment echoed by shareholders in the Exchange. Shortly after Macquarie withdrew its offer, the LSE received an unsolicited approach from NASDAQ valuing the company at £2.4 billion. This too it rejected. NASDAQ later pulled its bid, and less than two weeks later on 11 April 2006, struck a deal with LSE's largest shareholder, Ameriprise Financial's Threadneedle Asset Management unit, to acquire all of that firm's stake, consisting of 35.4 million shares, at £11.75 per share. NASDAQ also purchased 2.69 million additional shares, resulting in a total stake of 15%. While the seller of those shares was undisclosed, it occurred simultaneously with a sale by Scottish Widows of 2.69 million shares. The move was seen as an effort to force LSE to the negotiating table, as well as to limit the Exchange's strategic flexibility.

Subsequent purchases increased NASDAQ's stake to 25.1%, holding off competing bids for several months. United Kingdom financial rules required that NASDAQ wait for a period of time before renewing its effort. On 20 November 2006, within a month or two of the expiration of this period, NASDAQ increased its stake to 28.75% and launched a hostile offer at the minimum permitted bid of £12.43 per share, which was the highest NASDAQ had paid on the open market for its existing shares. The LSE immediately rejected this bid, stating that it "substantially undervalues" the company.

NASDAQ revised its offer (characterized as an "unsolicited" bid, rather than a "hostile takeover attempt") on 12 December 2006, indicating that it would be able to complete the deal with 50% (plus one share) of LSE's stock, rather than the 90% it had been seeking. The U.S. exchange did not, however, raise its bid. Many hedge funds had accumulated large positions within the LSE, and many managers of those funds, as well as Furse, indicated that the bid was still not satisfactory. NASDAQ's bid was made more difficult because it had described its offer as "final", which, under British bidding rules, restricted their ability to raise its offer except under certain circumstances.

In the end, NASDAQ's offer was roundly rejected by LSE shareholders. Having received acceptances of only 0.41% of rest of the register by the deadline on 10 February 2007, Nasdaq's offer duly lapsed. Responding to the news, Chris Gibson-Smith, the LSE's chairman, said: "The Exchange’s strategy has produced outstanding results for shareholders by facilitating a structural shift in volume growth in an increasingly international market at the centre of the world’s equity flows. The Exchange intends to build on its exceptionally valuable brand by progressing various competitive, collaborative and strategic opportunities, thereby reinforcing its uniquely powerful position in a fast evolving global sector."

On 20 August 2007, NASDAQ announced that it was abandoning its plan to take over the LSE and subsequently look for options to divest its 31% (61.3 million shares) shareholding in the company in light of its failed takeover attempt.[35] In September 2007, NASDAQ agreed to sell the majority of its shares to Borse Dubai, leaving the United Arab Emirates-based exchange with 28% of the LSE.

Proposed merger with TMX Group

On 9 February 2011, the London Stock Exchange Group announced they had agreed to merge with the Toronto-based TMX Group, the owners of the Toronto Stock Exchange, creating a combined entity with a market capitalization of listed companies equal to £3.7 trillion. Xavier Rolet, who currently is CEO of the LSE Group, would have head the new enlarged company, while TMX Chief Executive Thomas Kloet would have become the new firm president. The London Stock Exchange however announced it was terminating the merger with TMX on 29 June 2011 citing that "LSEG and TMX Group believe that the merger is highly unlikely to achieve the required two-thirds majority approval at the TMX Group shareholder meeting".[38] Even though the LSE obtained the necessary support from its shareholders, it failed to obtain the required support from TMX's shareholders.

OPENING TIMES

Normal trading sessions on the main orderbook (SETS) are from 08:00 to 16:30 local time every day of the week except Saturdays, Sundays and holidays declared by the exchange in advance. The detailed schedule is as follows:

Trade reporting 07:15–07:50

Opening auction 07:50–08:00

Continuous trading 08:00–16:30

Closing auction 16:30–16:35

Order maintenance 16:35–17:00

Trade reporting only 17:00–17:15

Holidays are currently: New Year's Day, Good Friday, Easter Monday, May Bank Holiday, Spring Bank Holiday, Summer Bank Holiday, and Christmas Day. Note that UK time is Greenwich Mean Time (GMT), with daylight saving time observed.

LONDON STOCK EXCHANGE CONTACTS

Head Office

10 Paternoster Square

London

EC4M 7LS

+44 (0) 20 7797 1000

Media Enquiries

London

+ 44 (0) 20 7797 1222

newsroom@lseg.com

Milan

+39 02 72426 360

media.relations@borsaitaliana.it

New York

+1 212 314 1199

Sri Lanka

+94 77 778 977

Investor Relations

London

+44 (0)20 7797 3322

irinfo-r@lseg.com

http://www.londonstockexchange.com/home/homepage.htm

http://www.lseg.com/resources/open-access

http://www.lseg.com/

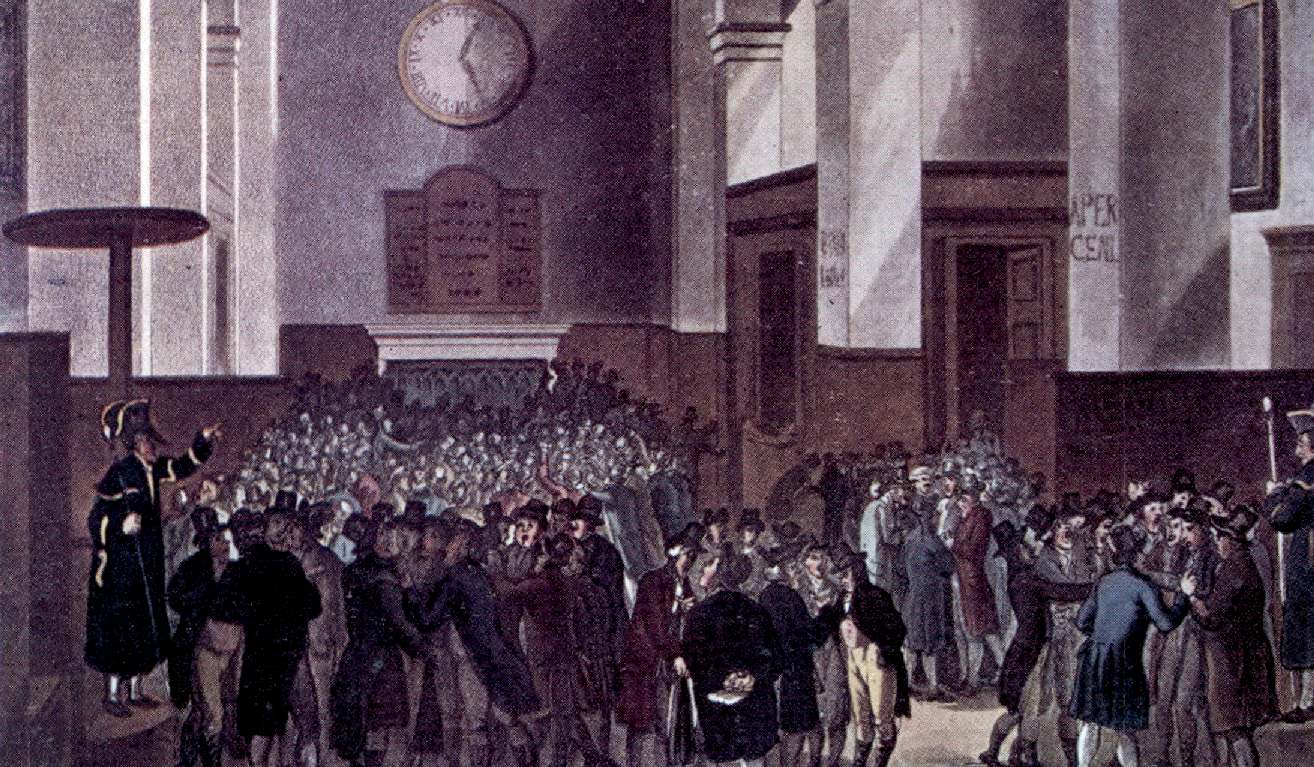

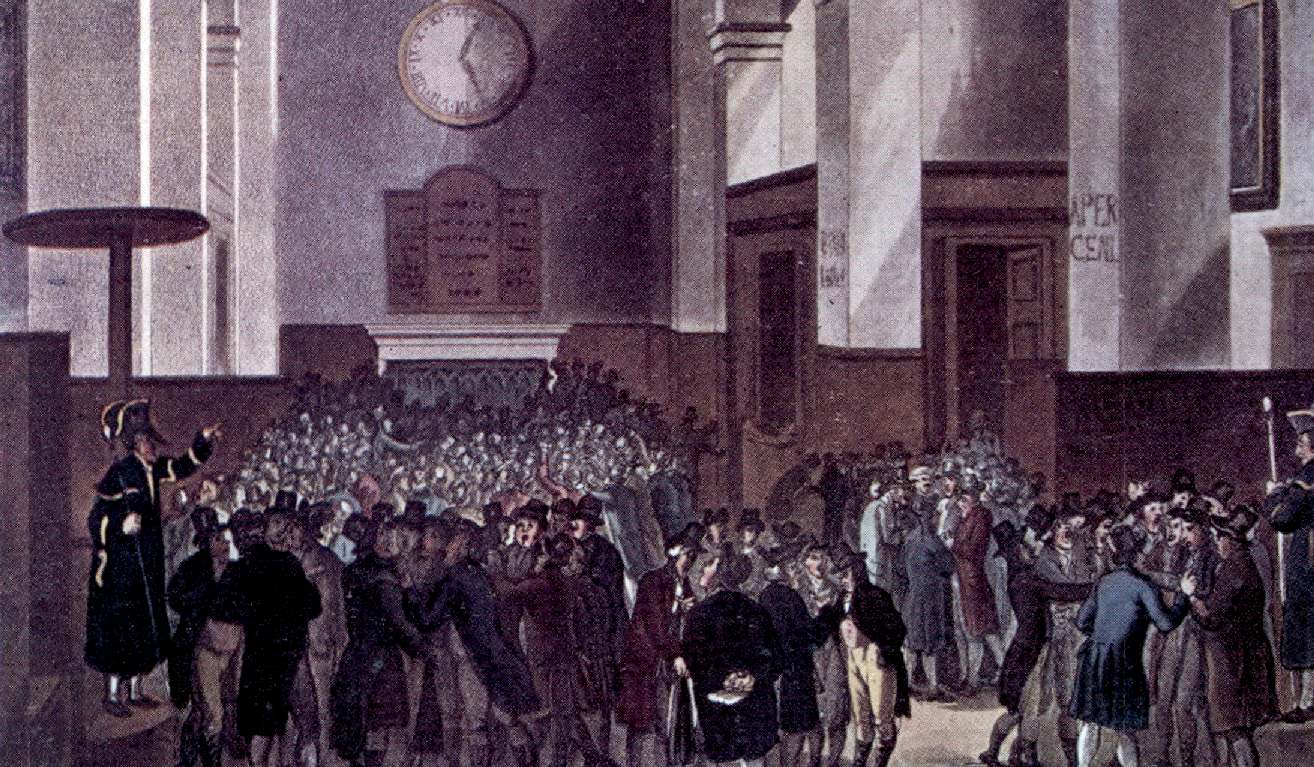

HISTORY

Coffee House

The Royal Exchange had been founded by English financier Thomas Gresham on the model of the Antwerp Bourse, as a stock exchange. It was opened by Elizabeth I of England in 1571.

During the 17th century, stockbrokers were not allowed in the Royal Exchange due to their rude manners. They had to operate from other establishments in the vicinity, notably Jonathan's Coffee-House. At that coffee house, a broker named John Casting started listing the prices of a few commodities, exchange rates and certain key provisions such as salt, coal and paper in 1698. Originally, this was not a daily list and was only published a few days of the week.

This list and activity was later moved to Garraway’s coffee house. Public auctions during this period were conducted for the duration that a length of tallow candle could burn; these were known as "by inch of candle" auctions. As stocks grew, with new companies joining to raise capital, the royal court also raised some monies. These are the earliest evidence of organised trading in marketable securities in London.

Royal Exchange

After Gresham's Royal Exchange building was destroyed in the Great Fire of London, it was rebuilt and re-established in 1669. This was a move away from coffee houses and a step towards the modern model of stock exchange.

The Royal Exchange not only housed brokers but also merchants and merchandise. This was the birth of a regulated stock market, which had teething problems in the shape of unlicensed brokers. In order to regulate these, Parliament brought out an act in 1697 that levied heavy penalties, both financial and physical to those brokering without a licence. It also set a fixed number of brokers (at 100), which was later increased as the size of the trade grew. This invariably led to several problems of its own, one of which was that traders began leaving the Royal Exchange, either by their own decision or through expulsion, and started dealing in the streets of London. The street in which they were now dealing was known as 'Exchange Alley', or 'Change Alley' which was suitably placed close to the Bank of England. Parliament tried to regulate this and ban the unofficial traders from the Change streets.

Traders became weary of "bubbles" when companies rose quickly and fell, so they persuaded Parliament to pass a clause preventing "unchartered" companies from forming.

After the Seven Years' War (1756–1763), trade at Jonathan's coffee house boomed again. In 1773, Jonathan, together with 150 other brokers, formed a club and opened a new and more formal "Stock Exchange" in Sweeting's Alley. This now had a set entrance fee, through which traders could enter the stock room and trade securities. It was, however, not an exclusive location for trading, as trading also occurred in the Rotunda of the Bank of England. Fraud was also rife during these times and in order to deter such dealings, it was suggested that users of the stock room pay an increased fee. This was not met well and ultimately, the solution came in the form of annual fees and turning the Exchange into a Subscription room.

The Subscription room created in 1801 was the first regulated exchange in London, but the transformation was not welcomed by all parties. On the first day of trading, non-members had to be expelled by a constable. In spite of the disorder, a new and bigger building was planned, at Capel Court.

William Hammond laid the first foundation stone for the new building on 18 May. It was finished on 30 December when "The Stock Exchange" was incised on the entrance.

First Rule Book

In the Exchange's first operating years, on several occasions there was a clear set of regulations or fundamental laws missing for the Capel Court trading. In February 1812, the General Purpose Committee confirmed a set of recommendations, which later became the foundation of the first codified rule book of the Exchange. Even though the document was not a complex one, topics such as settlement and default were, in fact, quite comprehensive.

With its new governmental commandments and increasing trading volume in place, the Exchange was progressively becoming an accepted part of the financial life in the City. In spite of continuous criticism from newspapers and the public, the government used the Exchange's organised market (and would most likely not have managed without) to raise the enormous amount of money required for the wars against

Napoleon.

Foreign and regional exchanges

After the war and facing a booming world economy, foreign lending to countries such as Brazil, Peru and Chile was a growing market. Notably, the Foreign Market at the Exchange allowed for merchants and traders to participate as well and The Royal Exchange hosted all transactions where foreign parties were involved. The constant increase of overseas business meant eventually the dealing in foreign securities had to be allowed within all of the Exchange's premises.

Just as London enjoyed growth through international trade, the rest of Great Britain also benefited from the economic boom. Two other cities in particular showed great business development, Liverpool and Manchester. Consequently, in 1836 both the Manchester and Liverpool Stock Exchanges were opened. Some stocks were known to rise in price by 10, 20 or even 30 per cent in a week. These were times when stockbroking was considered a real business profession and such attracted many entrepreneurs. Nevertheless, with booms came busts, and in 1835 the "Spanish panic" hit the markets, also followed by a second one two years later.

The Exchange before the World Wars

By June 1853, both participating members and brokers were taking up so much space that the Exchange was now uncomfortably crowded and continual expansion plans were taking place. Having already been extended west, east and northwards, it was then decided the Exchange needed an entire new establishment. Thomas Allason was appointed as the main architect, and in March 1854 the new brick building inspired from the Great Exhibition stood ready. This was a huge improvement of both surroundings and space, with twice the floor space available.

By the late 1800s, the telephone, ticker tape and the telegraph had been invented. Those new technologies led to a revolution in the work of the Exchange.

FIRST WORLD WAR

As the financial centre of the world, both the City and the Stock Exchange were hit hard by the outbreak of the First World War in 1914. Due to fears that borrowed money was to be called in and that foreign banks would demand their loans or raise interest, prices surged at first. The decision to close the Exchange for improved breathing space and to extend the August Bank Holiday to prohibit a run on banks, was hurried through by the committee and Parliament, respectively. The Stock Exchange ended up being closed from the end of July until the New Year, causing street business to be introduced again as well as the "challenge system".

The Exchange was set to open again on 4 January 1915 under tedious restrictions, as transactions were to be in cash only. Due to the limitations and challenges on trading brought by the war, almost a thousand members quit the Exchange between 1914 and 1918. When peace returned in November 1918, the mood on the trading floor was generally cowed. In 1923 the Exchange received its own coat of arms, with the motto "Dictum Meum Pactum", My Word is My Bond.

SECOND WORLD WAR

In 1937 officials at the Exchange used their experiences from the First World War to draw up plans on how to handle a new war situation. One of the main concerns were air-raids and the subsequent bombing of the Exchange's perimeters, and one suggestion was a move to Denham. This however never took place. On the first day of September 1939, the Exchange closed its doors "until further notice" and two days later war was declared. Unlike in the prior war, the Exchange opened its doors again six days later, on 7 September.

As the war escalated into its second year, the concerns for air raids were greater than ever. Eventually, on the night of 29 December 1940 one of the greatest fires in London’s history took place. The Exchange’s floor was hit by a clutch of incendiary bombs, which fortunately were extinguished quickly. Trading on the floor was now drastically low and most was done over the phone to reduce the possibility of injuries.

The Exchange was only closed for one more day during wartime, in 1945 due to damage from a V-2 rocket. Nonetheless trading continued in the house’s basement.

POST WAR

After decades of uncertain if not turbulent times, business boomed for the stock market in the late 1950s. This pushed the officials to find a more suitable space for its new accommodation. The work on the new Stock Exchange Tower began in 1967. The Exchange’s new 321 feet-high building had 26 storeys with council and administration at the top, and middle floors let out to affiliate companies. Queen Elizabeth II opened the building on 8 November 1972, and the finalised building was a new City landmark, with its 23,000 sq ft (2,100 m2) trading floor.

1973 marked the year of changes for the Stock Exchange. Firstly, two trading prohibitions were to be abolished. A report from the Monopolies and Mergers Commission recommended the admittance of both women and foreign-born members on the floor. Secondly, in March the London Stock Exchange was to (formally) amalgamate with the eleven British and Irish regional exchanges, including the Scottish Stock Exchange. This expansion led to the creation of a new position of Chief Executive Officer; after an extensive search this post was given to Robert Fell. Governmental changes also continued in 1991, when the governing Council of the Exchange was replaced with a Board of Directors drawn from the Exchange’s executive, customer and user base. This also marked the first time the trading name became "The London Stock Exchange".

FTSE 100 Index (pronounced "Footsie 100") was launched by the Financial Times and Stock Exchange partnership in February 1984. This turned out to be one of the most useful indices of all and tracked the movements of the 100 leading companies listed on the Exchange.

IRA BOMBING

On 20 July 1990 a bomb planted by the IRA exploded in the men's toilets behind the visitors' gallery. The area had already been evacuated and nobody was injured. About 30 minutes before the blast at 8:49 a.m., a man who said he was a member of the IRA told Reuters that a bomb had been placed at the exchange and was about to explode. Police officials said that if there had been no warning, the human toll would have been very high. The explosion ripped a hole in the 23-story building on Threadneedle Street and sent a shower of glass and concrete onto the street.[8] The long term trend towards electronic trading had been reducing the Exchange's status as a visitor attraction and, although the gallery reopened, it was closed permanently in 1992.

"BIG BANG"

The biggest happening of the 1980s was the sudden deregulation of the financial markets in the UK in 1986. The phrase "Big Bang" was coined to describe measures including abolition of fixed commission charges and of the distinction between stockjobbers and stockbrokers on the London Stock Exchange, as well as the change from an open outcry to electronic, screen-based trading.

In 1995 the Exchange launched the Alternative Investment Market, the AIM, to allow growing companies to expand to international markets. Two years later the Electronic Trading Service (SETS) was launched, bringing greater speed and efficiency to the market. Following this, the CREST settlement service was also launched. In 2000, the Exchange's shareholders voted to become a public limited company, London Stock Exchange plc. The LSE also transferred its role as UK Listing Authority to the Financial Services Authority (FSA-UKLA)

EDX London, a new international equity derivatives business, was created in 2003 in partnership with OM Group. The Exchange also acquired Proquote Limited, a new generation supplier of real-time market data and trading systems.

The old Stock Exchange Tower became largely redundant with Big Bang, which deregulated many of the Stock Exchange's activities as it enabled an increased use of computerised systems that allowed dealing rooms to take over work previously done by face-to-face trading. Thus in 2004 the Stock Exchange moved to a brand-new headquarters in Paternoster Square, close to St Paul's Cathedral.

In 2007 the London Stock Exchange merged with Borsa Italiana, creating the London Stock Exchange Group (LSEG). The Group operates out of the Stock Exchange's headquarters in Paternoster Square.

OCCUPY LONDON

The Stock Exchange in Paternoster Square was the initial target for the protesters of Occupy London on 15 October 2011. Attempts to occupy the square were thwarted by police.

Police sealed off the entrance to the square as it is private property, a High Court injunction having previously been granted against public access to the square.

The protesters moved nearby to occupy the space in front of St Paul's Cathedral. The protests were part of the global "Occupy" protests.

THE TELEGRAPH 2015 OCT 8

The London Stock Exchange Group is to sell the asset management arm of the Frank Russell investment firm it bought last year.

The company behind London’s stock exchange, clearing houses and financial indices has agreed to sell Russell Investments for $1.15bn (£752m) in cash to US private equity group TA Associates.

LSE, which put up Russell Investments on the block in February, said it would receive net proceeds of about $920m from the sale after tax and expenses.

Xavier Rolet, chief executive of LSE, said he was “very pleased” with the deal.

“We look forward to working with them [TA] and Russell Investments’ management to deliver a smooth transition of ownership.

“Until completion, LSE remains firmly committed to Russell Investments, its global customer base, its exemplary client service and its innovative product offering.”

CITIC - one of the biggest brokerage firms in China - was reportedly the frontrunner to take over Russell Investments, before a stock market rout in the Far Eastern country and an alleged investigation into CITC by the government hit it hard.

LSE, which was advised on the sale of Russell Investments by JP Morgan and Goldman Sachs, recently reported a 90pc rise in half-year revenues.

Revenues of £1.17bn were up 9pc based on underlying performance, while adjusted pre-tax profits climbed by 20pc to £205.2m.

Russell’s investment business generated revenues of £498m.

LSE shares dropped 0.8pc to £24.51 before news of the sale emerged.

The London Stock Exchange recently reported a 90pc rise in half-year revenues, helped by its newly acquired Russell business.

Revenues of £1.17bn were up 9pc based on underlying performance, while adjusted pre-tax profits climbed by 20pc to £205.2m.

By John Ficenec

JUNE

25 2015 - LONDON

STOCK EXCHANGE, NEW FIGURES

New issues on LSEG's main markets were up 29 per cent in the period, while average daily UK equity value traded was up eight per cent to £5.3bn. On the

FTSE, total ETF assets under management benchmarked up 14 per cent to $236bn (£150.2bn), while the same figure on newly-acquired index provider Russell rose 22 per cent to $157bn.

TRADEMARKS

Case details for trade mark UK00002000611

Status: Registered

Filing date: 31 October 1994

Date of entry in register: 22 August 1997

Renewal date: 31 October 2024

List of goods and services:

Class 9

Computer programs; magnetic cards, discs and tapes; microfiche; films; videos.

Class 16

Printed matter; printed publications; periodicals, books and booklets; stationery; writing instruments; diaries, address books, paper knives.

Class 35

Business information services and appraisals; computer-assisted business information and research services; statistical information services; preparation and quotation of stock exchange prices and indices; business information storage and retrieval services.

Class 36

Financial information management and analysis services; stock exchange quotation and listing services; share price information services; provision of financial market for the trading of securities, shares and options; recording and registering the transfer of stocks, shares and securities, maintaining and recording the ownership of stocks, shares and securities; maintaining and recording the ownership of stocks, shares and securities; settlement services, trade matching services.

Class 38

Transmission of data, messages and information by computer, electronic mail; computer communication services; telecommunication of information (including web pages), computer programs and data; electronic mail services; provision of telecommunications access links to computer databases and the Internet.

Class 42

Computer time-sharing, leasing of access time to a computer database, rental of computer programmes; computer programming services.

Name and Address details:

Owner(s) name

London Stock Exchange plc

10 Paternoster Square, London, United Kingdom, EC4M 7LS

Country of Incorporation

United Kingdom

IPO representative name

Taylor Wessing LLP

5 New Street Square, London, United Kingdom, EC4A 3TW

Publication details

First advert Journal : 6174 Date of publication : 07 May 1997

EUROPEAN TRADEMARKS

Case details for trade mark EU013088976

Trade mark:

LONDON STOCK EXCHANGE GROUP

Status: Registered

Filing date: 16 July 2014

Date of entry in register: 30 December 2014

Renewal date: 16 July 2024

List of goods and services

Class 9

Computer programs; magnetic cards, discs and tapes; microfiche; films; videos; all of the aforesaid goods relating to the provision of stock exchange and capital markets services.

Class 16

Printed matter; printed publications; periodicals, books and booklets; stationery; writing instruments; diaries, address books, paper knives; all of the aforesaid goods relating to the provision of stock exchange and capital markets services.

Class 35

Business information services and appraisals; computer-assisted business information and research services; provision of business statistical information; business information storage and retrieval services; all of the aforesaid services relating to the provision of stock exchange and capital markets services.

Class 36

Financial information management and analysis services; stock exchange quotation and listing services; share price information services; provision of financial market for the trading of securities, shares and options; recording and registering the transfer of stocks, shares and securities, maintaining and recording the ownership of stocks, shares and securities; maintaining and recording the ownership of stocks, shares and securities; financial clearing and settlement services; services for enabling the trading of securities by matching orders for purchase with orders for sale; preparation and quotation of stock exchange prices and indices; all of the aforesaid services relating to the provision of stock exchange and capital markets services.

Class 38

Transmission of data, messages and information by computer, electronic mail; computer communication services; telecommunication of information (including web pages), computer programs and data; electronic mail services; provision of telecommunications access links to computer databases and the Internet; leasing of access time to a computer database; all of the aforesaid services relating to the provision of stock exchange and capital markets services.

Class 42

Computer time-sharing, rental of computer programmes; computer programming services; all of the aforesaid services relating to the provision of stock exchange and capital markets services.

Name and Address details

Holder's name:

London Stock Exchange plc

10 Paternoster Square, London, United Kingdom, EC4M 7LS

Representative:

TAYLOR WESSING LLP

5 New Street Square, London, United Kingdom, EC4A 3TW

Publication details -

First advert

Journal : 2014/177 Date of publication: 22 September 2014

Case details for trade mark EU001665983

Trade mark

Status: Registered

Relevant dates:

Filing date: 19 May 2000

Date of entry in register : 15 November 2001

Renewal date: 19 May 2020

Seniority date: 31 October 1994

Seniority country: United Kingdom

Seniority No: 2000611

List of goods and services

Class 9

Computer software and hardware; magnetic cards, discs and tapes, microfiche; films; videos; all the foregoing being related to one or more of business information services and appraisals, computer-assisted business information and research services, statistical information services, preparation and quotation of stock exchange prices and indices, business information storage and retrieval services, financial information management and analysis services, stock exchange quotation and listing services, share price information services, the provision of a financial market for the trading of securities, shares, futures and options, recording and registering the transfer of securities, shares, futures and options; maintaining and recording the ownership of securities, shares, futures and options, settlement services, trade matching services.Computer software and hardware; magnetic cards, discs and tapes; microfiche; films; videos.

Class 16

Printed matter; printed publications; periodicals, books and booklets; stationery; writing instruments; diaries, address books, paper knives, all the foregoing being related to one or more of business information services and appraisals, computer-assisted business information and research services, statistical information services, preparation and quotation of stock exchange prices and indices, business information storage and retrieval services, financial information management and analysis services, stock exchange quotation and listing services, share price information services, the provision of a financial market for the trading of securities, shares, futures and options, recording and registering the transfer of securities, shares, futures and options; maintaining and recording the ownership of securities, shares, futures and options, settlement services, trade matching services.Printed matter; printed publications; periodicals, books and booklets; stationery; writing instruments; diaries, address books, paper knives.

Class 35

Business information services and appraisals; computer-assisted business information and research services; statistical information services; preparation and quotation of stock exchange prices and indices; business information storage and retrieval services.

Class 36

Financial information management and analysis services; stock exchange quotation and listing services; share price information services; provision of a financial market for the trading of securities, shares, futures and options; recording and registering the transfer of securities, shares, futures and options; maintaining and recording the ownership of securities, shares, futures and options; settlement services, trade matching services.

Class 38

Transmission of data, messages and information by computer; electronic mail; computer communication services; telecommunication of information (including web pages), computer programs and data; electronic mail services; provision of telecommunications access links to computer databases and the Internet; all the foregoing being related to one or more of business information services and appraisals, computer-assisted business information and research services, statistical information services, preparation and quotation of stock exchange prices and indices, business information storage and retrieval services, financial information management and analysis services, stock exchange quotation and listing services, share price information services, the provision of a financial market for the trading of securities, shares, futures and options, recording and registering the transfer of securities, shares, futures and options; maintaining and recording the ownership of securities, shares, futures, and options, settlement services, trade matching services. Transmission of data, messages and information by computer; electronic mail; computer communication services; telecommunication of information (including web pages), computer programs and data; electronic mail services; provision of telecommunications access links to computer databases and the Internet.

Class 42

Computer time-sharing, leasing of access time to a computer database, rental of computer programmes; computer programming services; all the foregoing being related to one or more of business information services and appraisals, computer-assisted business information and research services, statistical information services, preparation and quotation of stock exchange prices and indices, business information storage and retrieval services, financial information management and analysis services, stock exchange quotation and listing services, share price information services, the provision of a financial market for the trading of securities, shares, futures and options, recording and registering the transfer of securities, shares, futures and options; maintaining and recording the ownership of securities, shares, futures and options, settlement services, trade matching services. Computer time-sharing, leasing of access time to a computer database, rental of computer programmes; computer programming services.

Name and Address details -

Holder's name:

London Stock Exchange plc

10 Paternoster Square, London, United Kingdom, EC4M 7LS

Representative:

TAYLOR WESSING LLP

5 New Street Square, London, United Kingdom, EC4A 3TW

Publication details

The trade mark was inherently non-distinctive, but evidence was submitted to show that, by the date of application, the mark has in fact acquired a distinctive character as a result of the use made of it.

COMPANIES HOUSE

COMPANY REGISTRATIONS

Name & Registered Office:

LONDON STOCK EXCHANGE (C) LIMITED

10 PATERNOSTER SQUARE

LONDON

EC4M 7LS

Company No. 07943990

Status: Active

Date of Incorporation: 09/02/2012

Country of Origin: United Kingdom

Company Type: Private Limited Company

Nature of Business (SIC):

74990 - Non-trading company

Accounting Reference Date: 31/12

Last Accounts Made Up To: 31/12/2015 (FULL)

Next Accounts Due: 30/09/2017

Last Confirmation Statement Date: 09/02/2017

Next Confirmation Statement Due: 23/02/2018

Mortgage: Number of charges: ( 0 outstanding / 0 satisfied / 0 part satisfied )

Last Members List: 09/02/2016

Name & Registered Office:

LONDON STOCK EXCHANGE GROUP PLC

10 PATERNOSTER SQUARE

LONDON

EC4M 7LS

Company No. 05369106

Status: Active

Date of Incorporation: 18/02/2005

Country of Origin: United Kingdom

Company Type: Public Limited Company

Nature of Business (SIC):

70100 - Activities of head offices

Accounting Reference Date: 31/12

Last Accounts Made Up To: 31/12/2015 (GROUP)

Next Accounts Due: 30/06/2017

Last Confirmation Statement Date: 18/02/2017

Next Confirmation Statement Due: 04/03/2018

Mortgage: Number of charges: 1 ( 0 outstanding / 1 satisfied / 0 part satisfied )

Last Members List: 18/02/2013

Last Bulk Shareholders List: 18/02/2011